Commercial real estate is not a monolithic asset class and investment returns will vary from one property to another depending on property type, market environment, location, loan structure, acquisition basis, tenant quality, occupancy rates, rent rolls and other factors.

Know What You Own

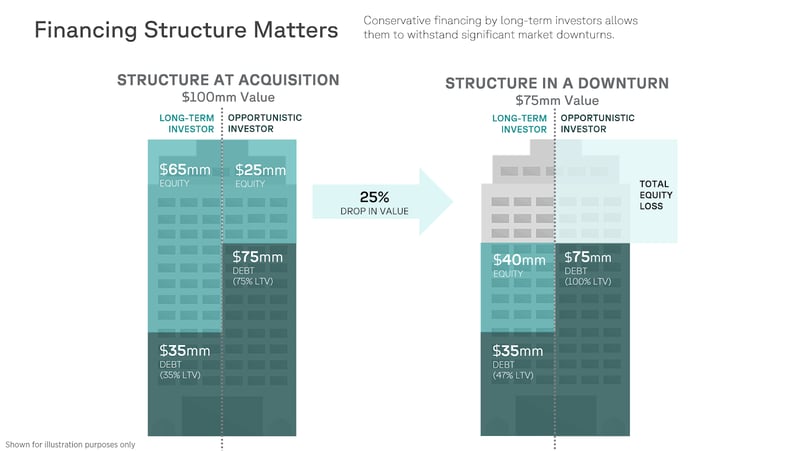

In our view, one of the most effective ways to illustrate how dynamic commercial real estate can be is to compare a commercial office building that, in one instance, was acquired and financed from a conservative long-term perspective and another instance where the investment manager pursued a more opportunistic approach with a much higher LTV.

A Tale of Two Owners

Source: IDR Investment Management LLC

-

In this scenario, one asset manager purchases a high-quality core office building in a major metropolitan market and finances the acquisition with a 10-year, fixed-term first mortgage at a 35% loan-to-value (LTV) ratio. In the second scenario, an asset manager purchases the same high-quality core office building but structures the financing with a total 75% loan-to-value (LTV) ratio.

-

Manager #1 seems to have pursued a more conservative strategy. Manager #2’s strategy was more opportunistic, using higher leverage with the goal of boosting investment returns. After managing the properties for a few years, the commercial real estate market entered a late-stage cycle where property values declined significantly.

-

Both properties depreciated 25% in value over the next 12 months. Manager #1’s conservative capital structure enabled the firm to continue operating, providing investors with continued (albeit reduced) income. Manager #2, however, was unable to service his loan, which had climbed to a 100% LTV ratio. Investors and the manager lost their entire investment.

While investors participate in private real estate with the obvious objectives of receiving regular income and attractive returns, commercial markets do experience cycles of growth and decline, just like the economy.

Unlike other broadly understood asset classes where returns are much more homogenous, commercial real estate performance can vary dramatically depending on a multitude of factors. Situations like the office asset example illustrate why it’s important to understand the investment manager's strategy (core vs. opportunistic, etc.) and how that can impact returns.

Unexpected events that shift investor sentiment illustrate why it’s critical to work with only the most experienced commercial real estate asset managers and sponsors when evaluating investment opportunities for your clients. There is no substitute for the requisite industry knowledge they have acquired over decades of market cycles.

Disclosure

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Accordant Investments LLC (“Accordant”) is not adopting, making a recommendation for or endorsing any investment strategy or particular security or property mentioned in this presentation. All opinions are subject to change without notice and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Accordant cannot guarantee that the information herein is accurate, complete or timely. Past performance does not guarantee future results.

Accordant has not made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein including, but not limited to, (information obtained from third parties), and they expressly disclaim any responsibility or liability, therefore Accordant does not have any responsibility to update or correct any of the information provided in this Presentation.

Private real estate investments have the potential for value loss during the life of the investment and the sponsor can make no assurances that any investment will achieve its objectives, goals, generate positive returns or avoid losses.