In previous posts, we have discussed the merits of private commercial real estate (CRE) and how allocating to this asset class may help diversify a traditional stock and bond portfolio and potentially improve your clients' investment outcomes.

RIAs who have embraced private CRE, often ask how large an allocation is required to have a meaningful impact on a portfolio's performance. We help answer that question in this discussion.

The Real Estate Universe

As the third-largest investable asset class, most investment advisors recognize that a well-diversified investment portfolio may include a meaningful allocation to real estate. Globally, commercial real estate represents a $24 trillion market. In the U.S., the aggregate size of the U.S. real estate market of an institutional nature is approximately $6.5 trillion.

Source: https://www.msci.com/documents/10199/a4535e8e-3b0d-f34d-4a0b-dc73058f7469

The pure size of the real estate market would suggest that a significant sleeve of many investor's portfolios should consider an allocation to the asset class. Moreover, modern portfolio theory would hold that well-diversified portfolios should include allocations to all major asset classes. But opinions vary on how much should be allocated to real estate and to what type of investment?

Public or Private?

For convenience, many advisors access the CRE market for their clients by investing in actively managed public REITs, public real estate mutual funds, or low-cost passive real estate ETFs. These securities are generally liquid investments available in a wide range of different strategies, making them a popular choice among many advisors.

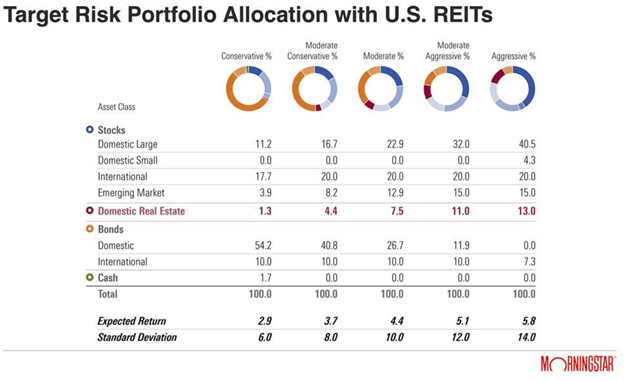

A recent analysis by Morningstar sponsored by Nareit, suggests that the optimal allocation for five different portfolios targeting specific risk/return profiles includes public REIT allocations ranging between 4% and 13%, depending on the investor's risk profile and time horizon.

Source: reit.com

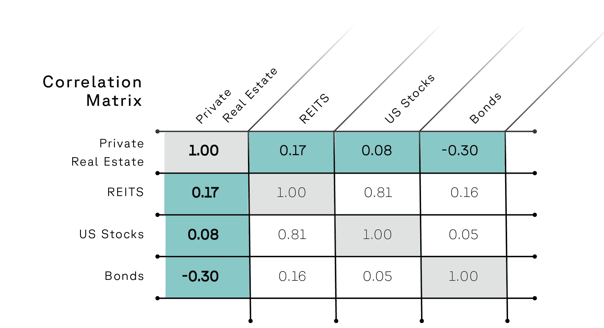

Institutional investors and ultra-high net worth individuals generally prefer allocating to real estate using private CRE investments. Moreover, as this chart illustrates, private CRE has a low correlation to publicly-traded securities. This may help improve diversification and provide more stabilized income and total returns since private CRE is not as sensitive to movements in the public markets.

Source: NFI-ODCE Index (private real estate), FTSE Nareit Equity REITs, S&P 500 (U.S. stocks), Bloomberg Barclays U.S. Aggregate Bond Index (bonds) and Vanguard Total International Stock Index Fund Investor Shares (VGTSX) (international stocks). 15-year correlation of total returns for all asset classes as of Q1 2023. Past performance is not indicative of future results.

Allocations among the groups opting to use private CRE generally call for 10% or more of an overall investment portfolio. According to a recent forecast by research firm, Private Equity Real Estate (PERE):

"Given real estate's diversification benefits, stable income, and strong return potential, we expect average institutional investor allocations will approach 11% in 2022." - perenews.com

And high-net-worth investors are likely to continue following a similar allocation strategy as revealed in a recent survey by global investment firm KKR:

“Private equity and real estate were the only alternative investments to see portfolio growth from high-net-worth families between 2017 and 2020. Real estate made up 11% of their assets, the third-largest share.” - KKR.com

And finally, in its 2022 Private Markets Report, Mercer suggests that the flow of capital into private CRE should only accelerate.

“The magnitude of investors seeking to increase real estate allocations continues to grow. Fueled by market recoveries, the amount of capital seeking real estate investments has outpaced the deployment of capital by investment firms.” - mercer.com

Identifying Your Allocations

Allocating to real estate is a widely-help practice among most advisors. It's been reported that as many as 83% of financial advisors allocate a portion of their client's portfolios to public REITs.1

But ask a few RIA colleagues how much they allocate to real estate, and you are likely to get a range of different answers. Obviously, you design and manage your portfolios to meet each client's specific risk/return profiles and goals. So, any real estate allocation will depend on a given client's risk appetite and objectives.

However, as you've seen here, there is a prevailing thought among many industry research groups and trade organizations suggesting an allocation of 10% or more might be appropriate for many investors. And for those investors with long time horizons of 40 years or more, Wilshire Associates' research supports an allocation of more than 15% as an optimal allocation.1

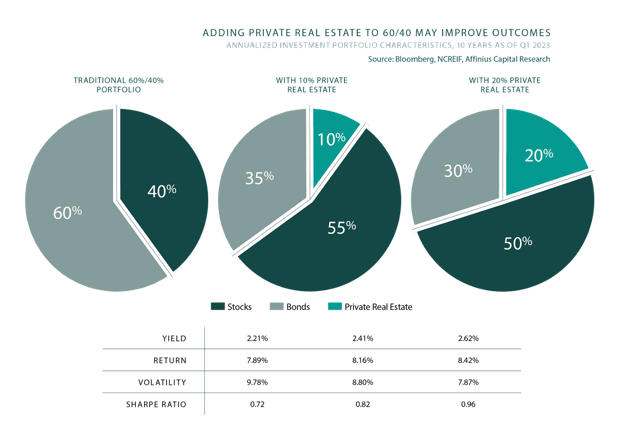

And as this hypothetical illustration suggests, an allocation of up to 20% private real estate can potentially improve the risk-adjusted return profile of a stock and bond portfolio in a meaningful way.

Adding Private Real Estate May Improve Outcomes

“Private Real Estate” is represented by the NFI-ODCE Index, “Stocks” are represented by the S&P 500 Index, and “Bonds” are represented by the Bloomberg Barclays U.S. Aggregate Bond Index. 10-Year annualized total returns for all asset classes are shown gross of any investment management advisory fees as of Q1 2023. Standard deviation (risk) is a measure of the volatility or dispersion of historical returns around their central tendency or mean return. Past performance is no guarantee of future results. The NFI-ODCE index is not directly investable. The Sharpe Ratio is the difference between the return of the portfolio and the risk-free return (represented by the 3-Month Treasury rate), divided by the volatility of the portfolio. It represents the amount of additional return achieved per unit of risk.

---

Important Disclosures

These materials are for educational purposes only and do not constitute an offer to sell or a solicitation of an offer to purchase any security or investment program. There are risks associated with real estate investing, which is affected by, among other things, adverse economic conditions, interest rates, oversupply and rent control laws, and shifts in consumer demand due to demographic changes, changes in spending patterns and lease terminations. Real estate investments involve different degrees of risk, and a client’s financial status and risk tolerance level must be considered.

1 https://www.wealthmanagement.com/reits/what-right-reit-allocation