Investment Strategies for Different Inflation Outcomes

How high? And how long? Answers to those two questions remain elusive for investment advisors implementing new strategies to help protect client portfolios amidst today’s high inflation.

Finding the right approach is even more challenging considering that traditional inflation-hedging investments like TIPS, gold, and commodities have not always performed effectively when consumer prices are rising.

What’s Behind Today’s Inflation?

Economists generally categorize inflation as one of two types. Demand-pull inflation occurs when aggregate demand exceeds aggregate supply, which causes prices to increase. Cost-push inflation happens when prices spike on critical items like oil, labor, and transportation, which cause prices to rise on other goods and services.

If you think our current inflation is exhibiting characteristics of both types, you’re right. And that may not bode well for consumers and investors alike in the year ahead. According to Desmon Lachman, a senior fellow at the American Enterprise Institute:

“Today, in the wake of the Covid-19 pandemic, it appears that we are having the unfortunate simultaneous combination of both demand-pull and cost-push inflation. That combination is likely to make inflation more long-lasting and less amenable to policy treatment than the Federal Reserve would like us to believe.” - Desmond Lachman, AEI. October 20211

The Search for an Inflation Hedge

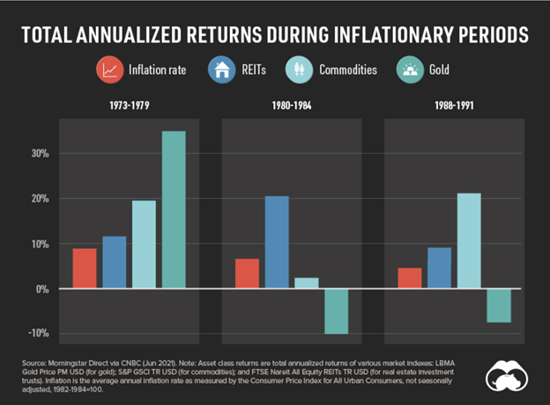

So, recognizing that today’s high inflation may not quickly subside and could be stubbornly persistent compels us to revisit how common hedging strategies performed during periods of high, moderate, and low inflation. As you can see in this illustration, there isn’t a genuine one-size-fits-all approach.

Note: TR USD stands for Total Return US dollars. Source: https://advisor.visualcapitalist.com/which-asset-classes-hedge-against-inflation/

Note: TR USD stands for Total Return US dollars. Source: https://advisor.visualcapitalist.com/which-asset-classes-hedge-against-inflation/

It’s interesting to note that during the persistently high inflation of the ‘70s, the three most common investments used to hedge – Public REITs , Commodities, and Gold – not only kept pace with the Consumer Price Index but beat it. However, the other inflationary periods tell a different story. Commodities fell behind when inflation was moderately high in the early ‘80s, with gold actually losing value at the same time. Gold fell again when inflation returned in the late ‘80s and early ‘90s.

In contrast, REITs performed well in each of the inflationary periods represented. and Commercial real estate is an asset class to consider today, when we simply don’t know what type of inflation lies ahead. Moreover, while we ended 2021 with an annual inflation rate of 7%, many economists expect that rate to come down in 2022, indicating it might be wise to plan for moderate to lower inflation.

Inflation’s Impact on Stocks and Bonds

The recent inflation spike has advisors revisiting their stock and bond allocations. Inflation has already caused the values of low-yielding bonds to drop. The history of inflation resulted in mixed performance of stocks. In some inflationary episodes, stocks provided an effective hedge. In others, rising costs and declining consumer purchasing power hurt both corporate profits and stocks.

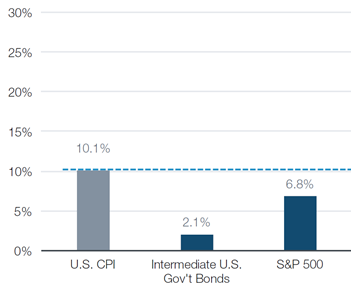

Advisors have not had to invest against a backdrop of sustained inflation for years. And the longest period of persistent inflation for U.S. markets – the ‘70s and early ‘80s – doesn’t shine a very bright light on the performance of stocks or bonds.

Asset Class Performance (March 1978 - September 1981)

Intermediate U.S. Government bonds are represented by the Barclay's Intermediate Corporate Bond Total Return Index. The S&P 500 is represented by the S&P 500 Index, which measure the performance of large cap U.S. stock market.

Intermediate U.S. Government bonds are represented by the Barclay's Intermediate Corporate Bond Total Return Index. The S&P 500 is represented by the S&P 500 Index, which measure the performance of large cap U.S. stock market.

Again, uncertainty about how long high inflation may last might be a good reason to consider an allocation to commercial real estate, which many advisors already use as a permanent portfolio fixture. Your real estate sleeve doesn’t necessarily have to be reduced if inflation quickly dissipates.

With Real Estate, “Private” Makes Sense

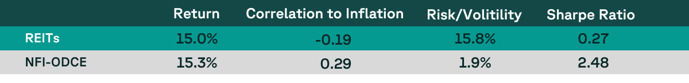

You have a choice when allocating to real estate. Historically, public REITs and private real estate (as represented here by the NFI-ODCE Index) have performed well as inflation hedges, especially during the heightened era of the late ‘70s and early ‘80s.

For reference, the NFI-ODCE private real estate index is the leading institutional benchmark for core private real estate in the U.S. The index is comprised of 27 of the preeminent institutional core real estate funds, representing nearly $300B invested in over 3000 prime, income-producing properties throughout the U.S.

Asset Class Characteristics vs. U.S. Inflation

March 1978 - September 1981

Sources: Bloomberg LP, Accordant Investments

REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index

However, note that during the inflationary period represented, private real estate exhibited greater positive correlation to inflation, a benefit during different inflationary times.

Also, with historically lower volatility than public REITs (which can be buffeted by stock market volatility), private real estate offered a smoother ride for investors comfortable with a long-term, less liquid approach. While past performance is not a guarantee of future results, private real estate provided better risk-adjusted returns, too, as indicated by the higher Sharpe ratio.

Inflation sensitivity, lower volatility, and a favorable risk/return profile are important benefits to consider when selecting a hedging strategy to help protect your clients.

---

Sources

1 https://www.aei.org/op-eds/americas-inflation-problem-wont-be-solved-by-ignoring-it/

2 https://advisor.visualcapitalist.com/which-asset-classes-hedge-against-inflation/