Midway through 2023, media coverage of the challenges many commercial office real estate owners are confronting has reached a feverish level. One may wonder if the sector’s current low vacancy rates and refinancing requirements will ultimately bring down our entire economy. We think not.

It's important for potential individual investors to recognize that not all commercial office real estate is created equal. For example, one might think two class-A office buildings* in a major metropolitan location would provide similar investment returns. But variables that include acquisition dates, purchase amounts, loan terms, tenant strength, rent rolls, and projected hold times can influence a property’s performance and investment returns.

If you have clients who are considering a private real estate allocation, it's helpful that they understand the investment profiles and strategies of the underlying property or properties. For office properties today, investment managers that pursue a conservative “core” strategy with low loan-to-value ratios and that have long weighted average fixed lease terms may carry significantly lower risk than other properties that are more opportunistic.

NFI-ODCE Index

We believe the best way to highlight the potential advantages of a core private real estate** strategy is to look at the NFI-ODCE index. The index is composed of a select group of premier institutional investment managers who adhere to very strict investment standards, diversify across the property spectrum, and invest in high-quality class-A properties across the Country.

Mitigating Risk in Today’s Market Cycle

We believe the office properties in the NFI-ODCE Index may be buffered from many of the issues facing other office landlords today, for these reasons:

- The properties in the Index are required to be core real estate assets which are generally considered the most conservative type of commercial real estate that investors can own. Core strategy managers focus on acquiring and managing high-quality class-A properties diversified geographically across property sectors within strong economies. Core properties usually require very little maintenance and typically are positioned to mitigate refinance risk by using long term fixed rate debt and long weighted average lease terms (WALTs).

- The office properties represented in the NFI-ODCE index are often premier trophy assets located in tier one cities that are developed, generally supported by strong economies, and have high occupancy rates. The average size of an office property in the ODCE Index is currently over $120 million dollars which typically means the lenders for these assets are large, established institutional firms rather than regional banks whose balance sheets are under current scrutiny.

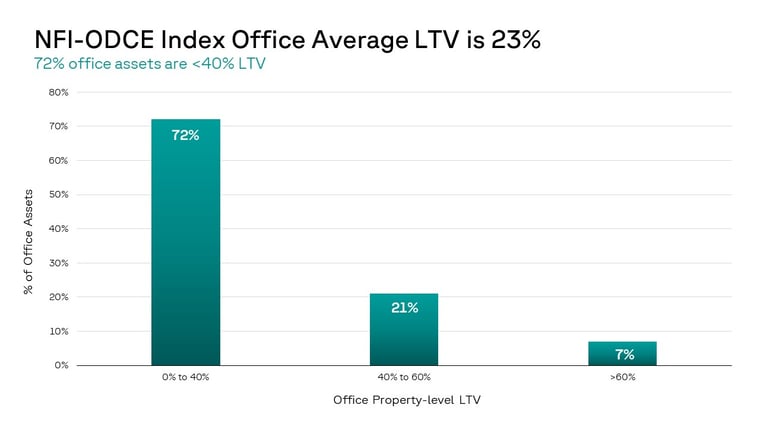

- Low leverage is a characteristic of core real estate investing. The average office loan-to-value (LTV) in the NFI-ODCE Index is remarkably low at 23%. Lower leverage may help ensure a manager will be able to make timely loan payments even if occupancy rates decline. In addition, over 70% of the office property loans in the index are longer-term fixed rate maturities. And the average weighted lease maturity for the office sector in NFI-ODCE is over five years.

Source: IDR, NFI-ODCE Index. Chart depicts the distribution of property-level LTV for office assets held within ODCE. Data as of 1Q 2023.

Source: IDR, NFI-ODCE Index. Chart depicts the distribution of property-level LTV for office assets held within ODCE. Data as of 1Q 2023.

Conclusion

Many advisors consider private real estate a strategic allocation that should hold a permanent position in many of their clients’ investment portfolios. These advisors understand that the commercial real estate industry goes through cycles (expansion, over-supply, recession, and recovery) much like the economy does. And certain sectors may be more susceptible to down-cycle environments, like today, than others. Commercial office property owners might attest to that.

Yet, as with any private real estate investment, it’s important for you to “know what you own” when considering a portfolio allocation for your clients. By fairly evaluating the conditions impacting the performance of the office sector and underlying strategies of the investment manager, you will readily see that not all commercial office space is created equal. And in an environment like today, where the office sector is certainly stressed, investment managers who are skilled at executing core strategies are those most likely to weather the current environment and be better positioned than others when the industry moves toward recovery.

.png?width=600&height=400&name=riverfront%20-%20canva%20(1).png)

*Class A office buildings are prestigious buildings competing for premier office users with rents above average for the area. Buildings have high quality standard finishes, state of the art systems, exceptional accessibility and a definite market presence. https://www.google.com/url?q=https://www.boma.org/BOMA/Research-Resources/Industry_Resources/BuildingClassDefinitions.aspx&sa=D&source=editors&ust=1692121378497207&usg=AOvVaw2F1d79VNVKDWhdJ1RJSFiD

**Core is the most conservative of the four common real estate investment strategies. A core strategy is characterized by ownership of stable, premier U.S. commercial properties with low leverage and high occupancy rates.