2022 was not kind to investors, and advisors who have been clinging to the 60% stock / 40% bond client portfolio now recognize a rebalance may be essential. Still, it is difficult for many to reallocate a model portfolio that has performed so well for clients for so many years.

A 60/40 Defense

Vanguard research shows that the 60/40 portfolio earned a tidy 9.1% annual return from 1926 through 2020. And according to Goldman Sachs, over the last decade (through 2021, net of inflation), the 60/40 portfolio returned an annual average of...9.1%.

With numbers like this, it is easy to see why many are reluctant to abandon ship despite the turbulent market investors endured last year. The premise of the 60/40 model has always been that equities provide growth while bonds help reduce portfolio volatility.

The goal is a balanced portfolio that can provide optimized risk-adjusted returns. And ever since the model emerged from the work of Modern Portfolio Theory work of Nobel prize-winner Harry Markowitz in 1952, the 60/40 allocation has largely delivered on its objective.

This Time It’s Different

Legendary investor Sir John Templeton is credited with identifying what he believed were the “four most dangerous words in the investment world”; this time, it's different. His caution was intended to remind investors that it is difficult to discern when market conditions appear different and when they are.

Yet, there are reasons to suggest the current economic and market environments present a confluence of challenges that may warrant a much closer look at the 60/40 portfolio and its ability to deliver the returns investors have been accustomed to. Among the concerns advisors need to consider are:

-

After bottoming out in 2020, when the 10-year Treasury hit an all-time low of 0.318%, yields had nowhere to go but up. Rising yields apply downward pressure on valuations, exposing fixed-income investors to negative returns and reducing a bond allocation’s role in balancing equity declines.

-

In 2022, equity markets have been roiled by a combination of geopolitical and economic conditions perhaps not seen in decades. High and persistent market volatility increases investor anxiety and can cause many to make poor, untimely changes to their portfolios.

-

Lingering inflation, and multiple rate increases by the Federal Reserve to combat it, have shaken consumer confidence. The potential for a recession may ultimately force advisors to make portfolio allocation changes to shield clients from equity exposure when the markets are most unkind.

When Stocks and Bonds Align

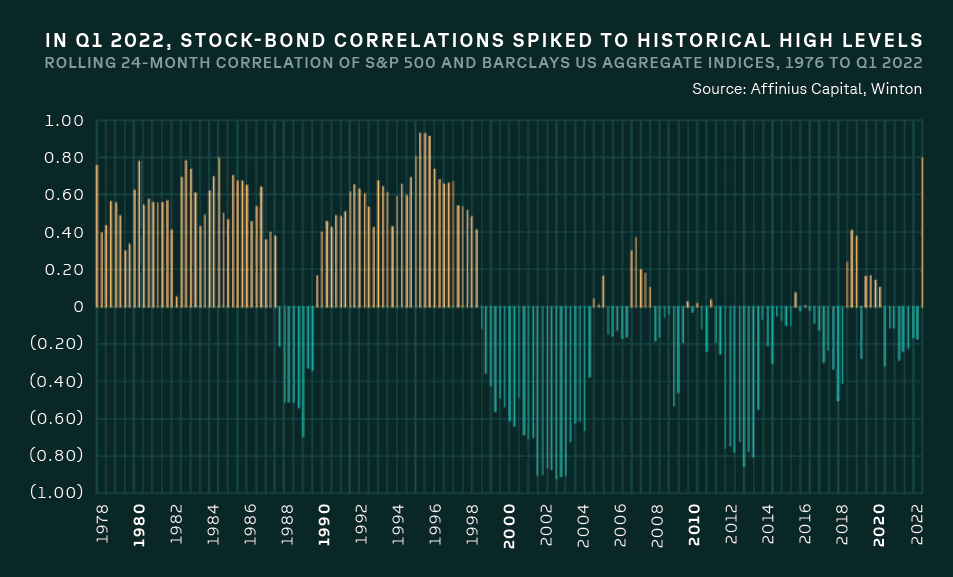

During the last century, it was not uncommon for stocks and bonds to post losses simultaneously. However, this has not been the recent experience of investors. Since 1980, with rates declining and inflation low, stocks and bonds have been less correlated, with bonds tending to rise during stock market declines, providing a dependable hedge.

2022, however flipped recent history on its head with stocks and bonds posting significant in tandem again, causing angst among investors who felt there was no place to hide. After a long bull run, historically high equity valuations and historically low interest rates made the 60/40 model more vulnerable to risk and the ensuing damage to portfolios was startling.

Seeking a New Approach

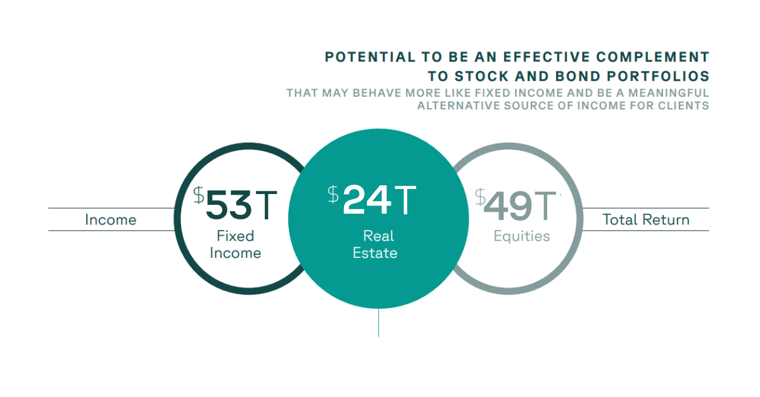

Today’s conditions may compel financial advisors to discover new ways to build better-balanced portfolios for clients. And an excellent place to start is by taking a closer look at real estate.

Real estate is the world’s third-largest asset class and can serve an essential role in complementing stocks and bonds. Many advisors consider real estate as the “third leg of the investment stool,” helping provide better balance and stability to a well-diversified portfolio.

Download your copy of our free guide, Building a Better 60/40 Portfolio with Core Private Real Estate, and explore why we believe this asset class should be a permanent fixture in your clients’ portfolios.