October 17, 2024

With Private Real Estate, You Would Do Well to Start with Core.

As an investment advisor, you know all too well the investment headwinds your clients face today.

- Markets in correction territory brought on by geopolitical disruptions and anticipated rate increases by the Fed trying to control inflation

- Stubbornly high inflation that may go significantly higher and last much longer than economists anticipated

- Frustratingly low bond yields are expected to increase, impacting bond valuations and portfolio performance

You also recognize a traditional 60/40 stock and bond portfolio is probably ill-equipped to provide the portfolio stability and risk-adjusted returns your clients have been accustomed to.

Meeting the Challenges

These fundamental challenges have turned many advisors towards commercial real estate (CRE). As an asset class that has historically been the domain of institutional investors, private CRE is now being adopted by advisors to address the investment challenges confronting their clients today.

As a proxy for CRE real estate, we use the NFI-ODCE index to illustrate the potential benefits of the core investment strategy.

The NFI-ODCE private real estate index is the leading institutional benchmark for core private real estate in the U.S. The index is comprised of 27 of the preeminent institutional core real estate funds, representing nearly $300B invested in over 3000 prime, income-producing properties throughout the U.S.

Core investment strategies, which often represent the largest share of private real estate allocations among many institutional investors, are defined as:

"Lower risk investment strategies utilizing low leverage and generally represented by equity ownership positions in stable U.S. operating properties diversified across regions and property types."- NCREIF.org

Core properties are generally located in stable, primary markets and have credit-worthy tenants secured with long-term leases. Properties are high quality and require minimal improvements. And when financed, leverage is typically below 30%.

Core strategies generally acquire and own assets with dependable income streams and relatively stable values. A core real estate investment may play a similar role to fixed-income securities for your clients. So, core may be more appropriate for clients with longer-term investment horizons looking for consistent income.

Potential Benefits of Core Real Estate

It is worth looking at how a core real estate allocation for your clients may help counter several of the most pressing difficulties they are facing today.

Market Volatility

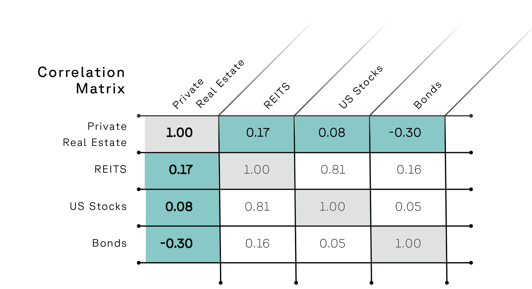

One potential feature of core private real estate is its low correlation to traditional asset classes. This can help improve portfolio diversification and potentially reduce volatility.

Source: Private real estate is represented by the NFI-ODCE Index, REITS refer to public REITS and are represented by the FTSE Nareit Equity REITs Index, U.S. stocks by the S&P 500Index, bonds by the Bloomberg Barclays U.S. Aggregate Bond Index, and international stocks by the Vanguard Total International Stock Index Fund Investor Shares (VGTSX). 15-year correlation of total returns for all asset classes as of Q1 2023. Past performance is not indicative of future results.

High Inflation

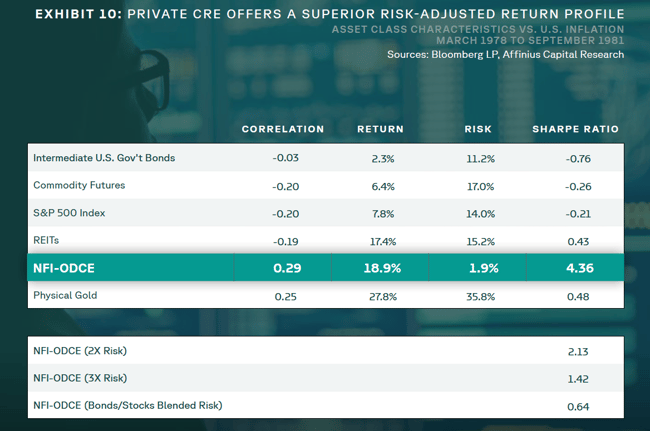

Another potential benefit of a core investment strategy is that it may effectively hedge against rising inflation. For example, commercial real estate leases often contain rent escalation clauses enabling owners to raise rents in step with the CPI.

While this chart only represents one episode of many U.S. inflationary periods, it illustrates that core real estate (represented by the NFI-ODCE index) held up well during our most memorable period of high, persistent inflation.

Asset Class Performance during “Great Inflation”

March 1978 - September 1981

Indices: Intermediate U.S. Gov't Bonds are represented by the Barclay's Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; Commodity Futures are represented by the S&P GSCI Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index.

Rising Rate Environment

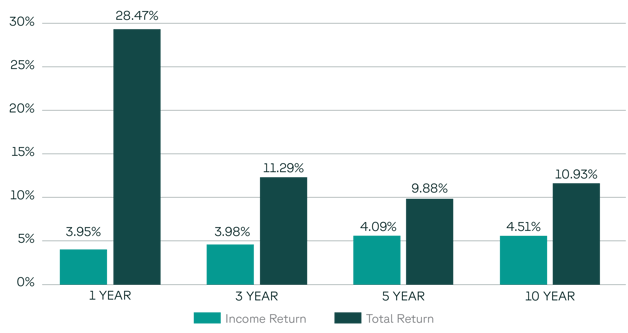

Historically, core investments have performed well throughout different market cycles, including rising rate environments. As illustrated here, core real estate has provided consistent income and total returns over extended periods of time.

Source: NFI-ODCE Index. Annualized gross income and total returns as of Q4 2022. Past performance is no guarantee of future results. The NFI-ODCE Index is not directly investable.

Source: NFI-ODCE Index. Annualized gross income and total returns as of Q4 2022. Past performance is no guarantee of future results. The NFI-ODCE Index is not directly investable.

Learn More

We trust this introduction to core real estate has helped you understand why this strategy has been an anchor in the private real estate industry for decades. To learn more download our guide "Building a More Balanced Portfolio".