IMPORTANT FOOTNOTES AND DISCLOSURES REGARDING THE ACCORDANT ODCE INDEX FUND

The Accordant ODCE Index Fund (the “ODCE Index Fund”) currently offers Class A Shares, Class I Shares, and Class Y Shares which will all be continuously offered at the ODCE Index Fund’s net asset value (“NAV”) per share, plus, in the case of Class A Shares, a maximum sales load of up to 5.75%, from which a dealer-manager fee of up to 0.75% of offering proceeds may also be paid. Holders of Class A Shares, Class I Shares, and Class Y Shares have equal rights and privileges with each other, except that Class I Shares and Class Y Shares do not pay a sales load or dealer manager fees. See “Ongoing Distribution and Servicing Fees” and “Summary of Fund Expenses” for information on servicing and distribution fees in the Prospectus. Class I Shares and Class Y Shares are each not subject to a sales load; however, investors could be required to pay brokerage commissions on purchases and sales of Class I or Class Y Shares to their selling agents. Inception date of the I shares is September 11, 2023. Class A shares and Class Y shares are available as of November 1, 2023.

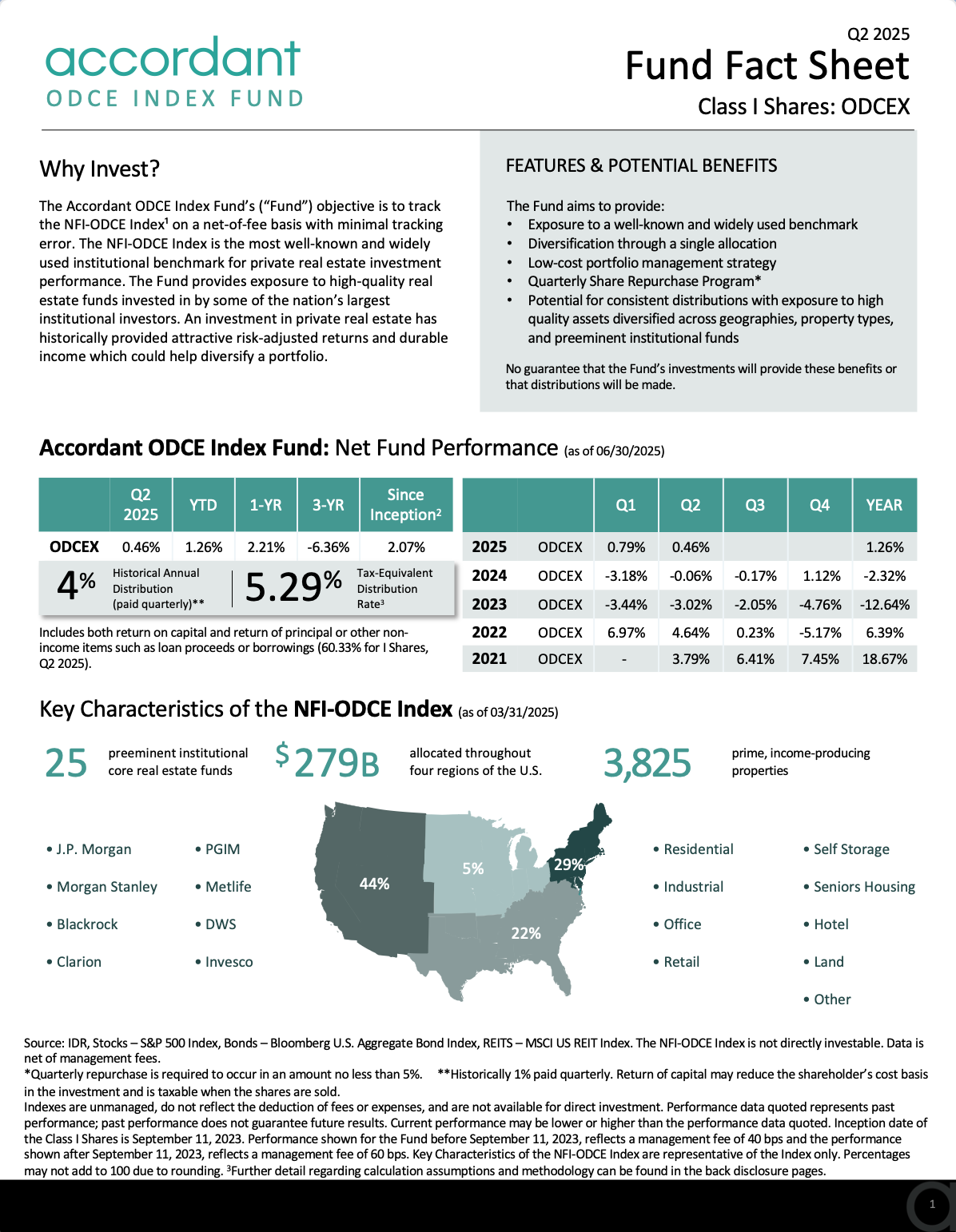

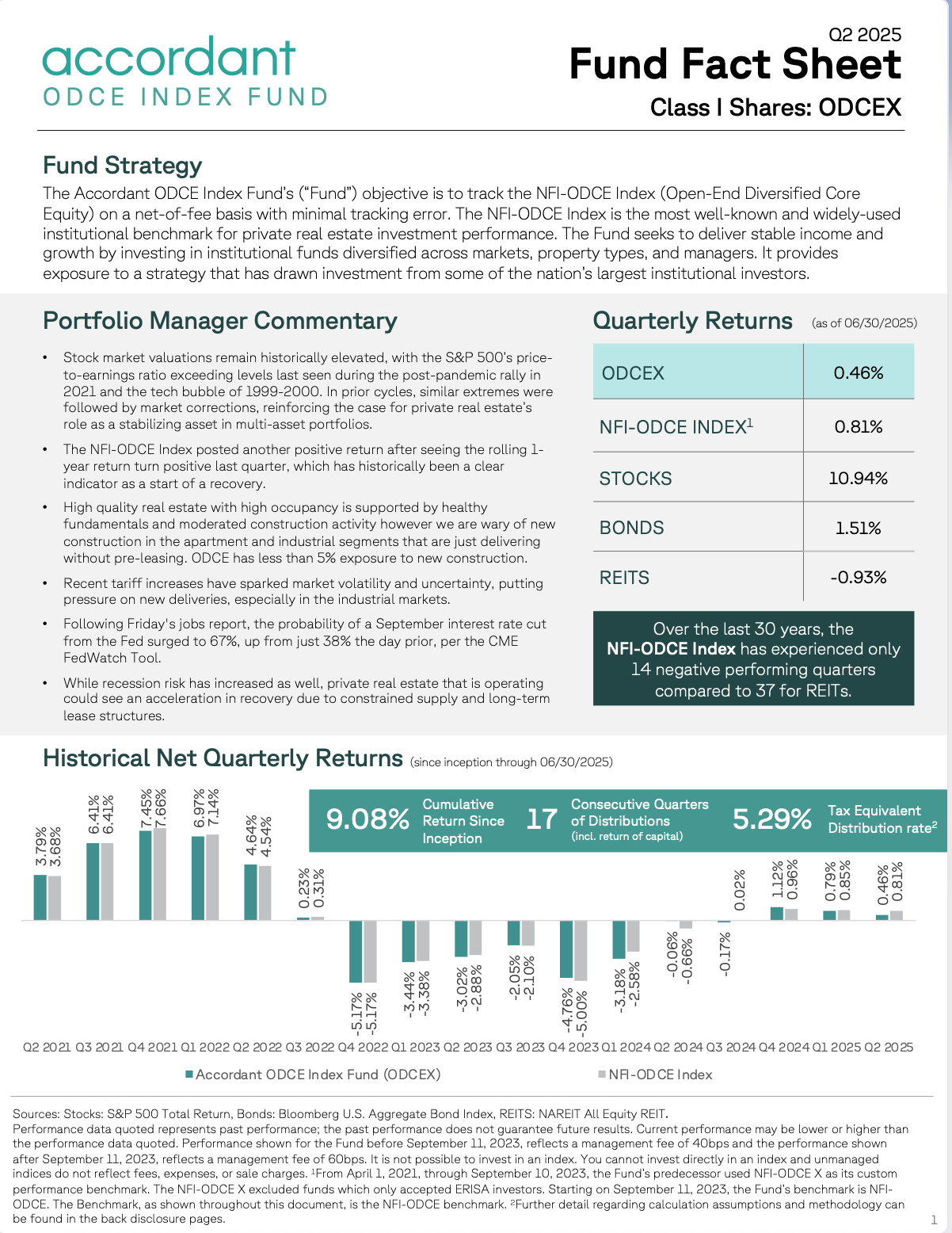

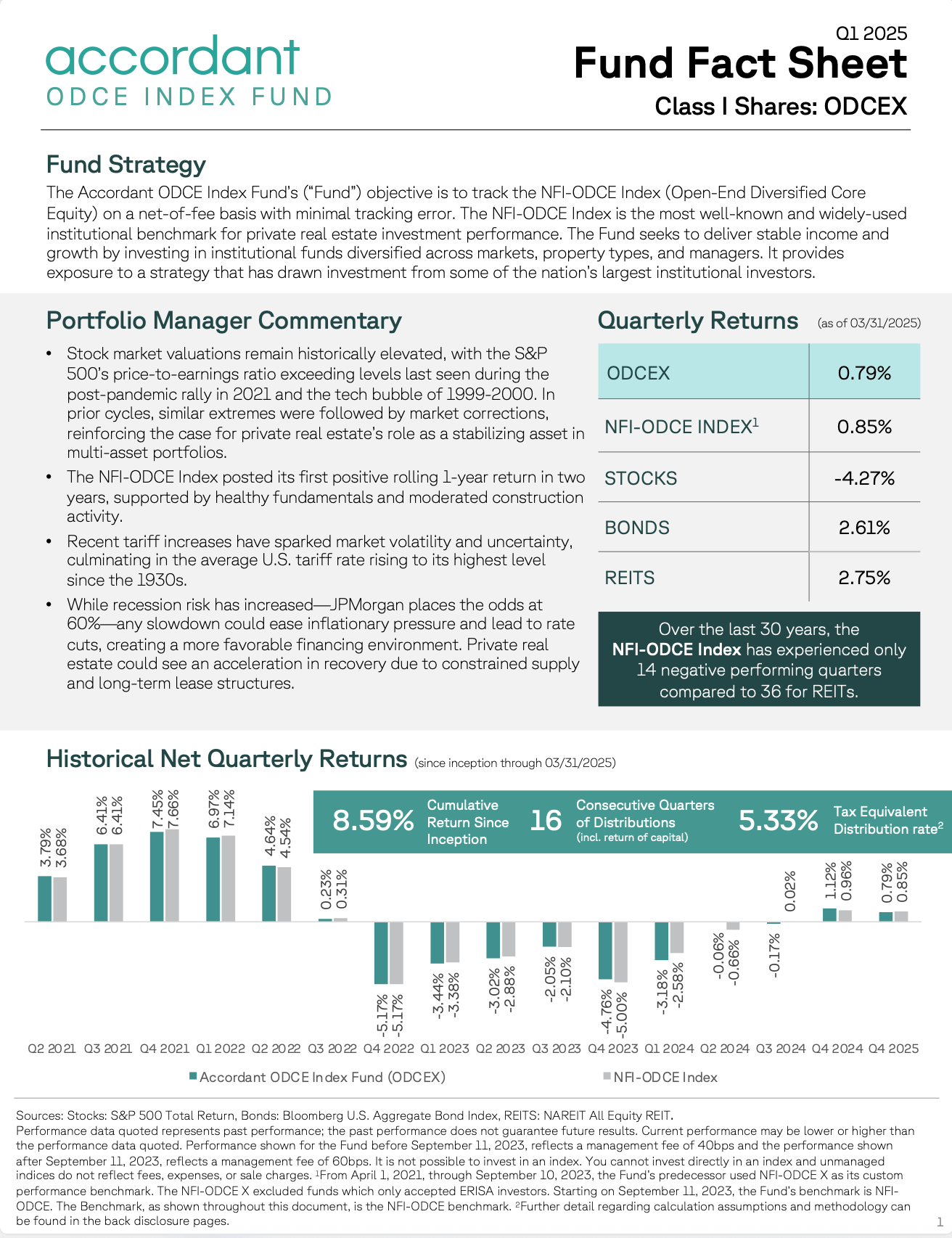

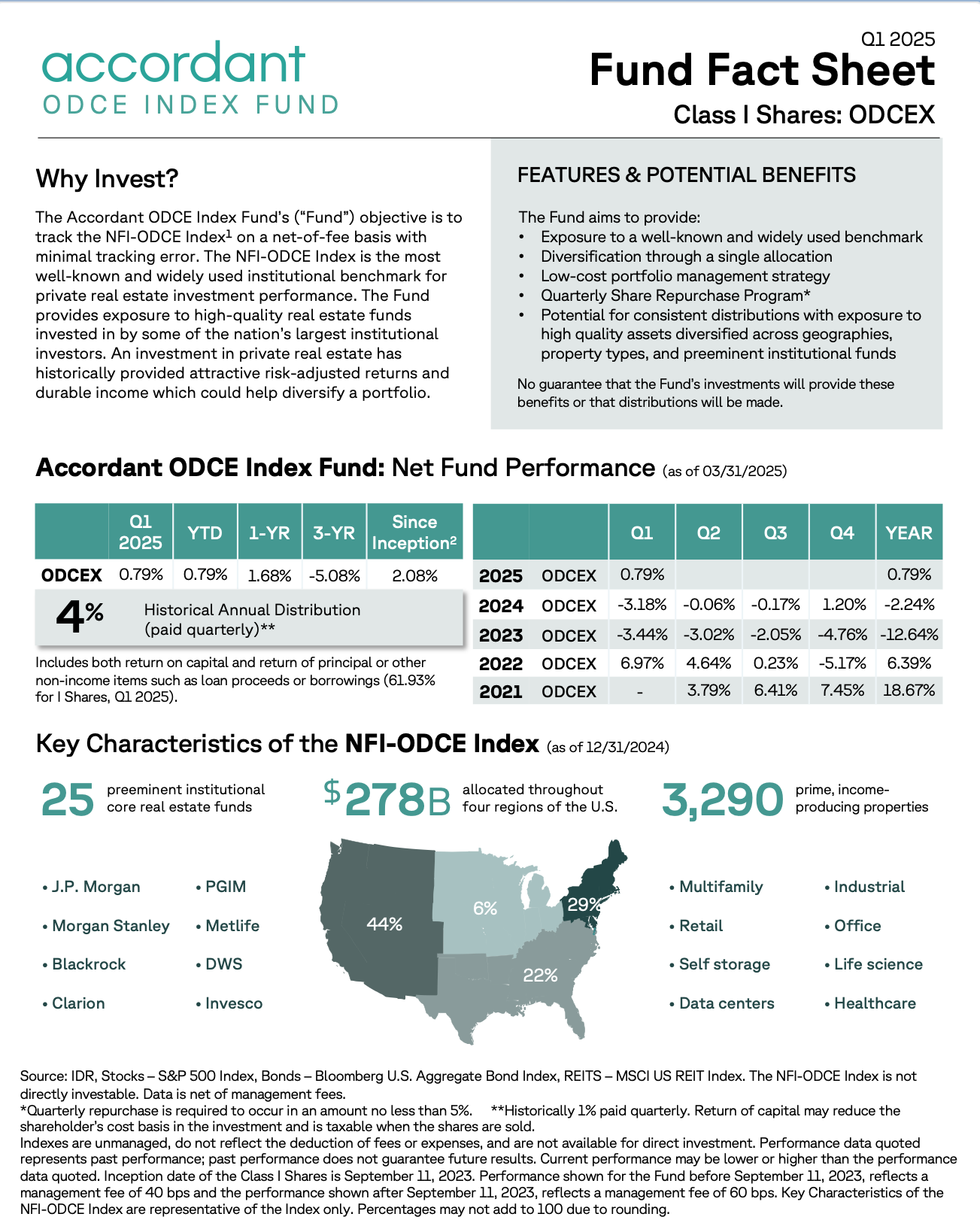

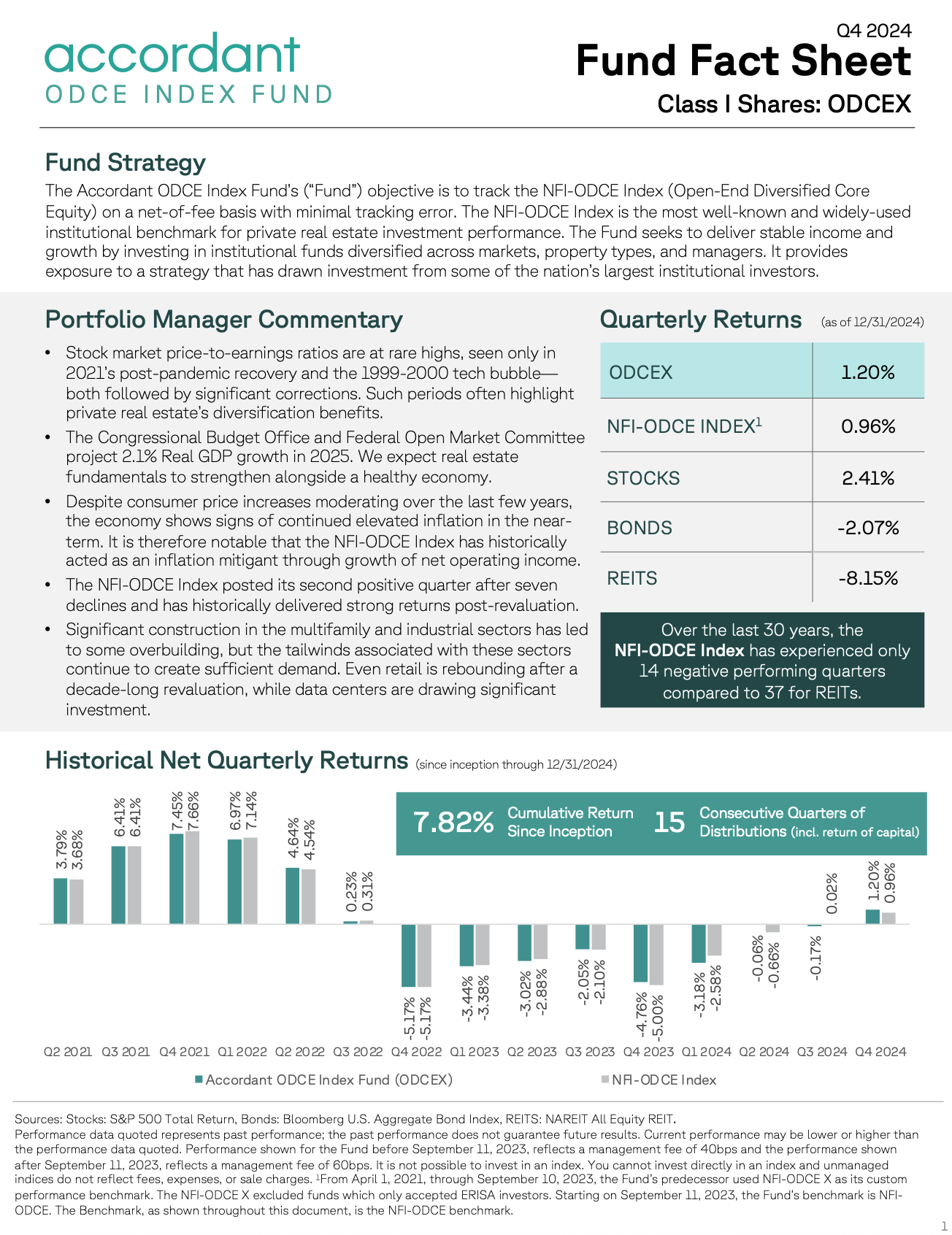

The ODCE Index Fund was previously registered as the IDR Core Property Index Fund, Ltd. (the “Predecessor”). The ODCE Index Fund’s investment adviser is Accordant Investments LLC(“Adviser”) and the ODCE Index Fund’s sub-adviser is IDR Investment Management, LLC (“Sub-Adviser”). The Predecessor Fund was a quarterly valued closed-end tender offer fund only available to accredited investors. Pursuant to a proxy filed with the SEC and a special shareholder meeting that occurred on August 31, 2023, the Predecessor Fund converted into the ODCE Index Fund which is a daily valued registered closed-end interval fund (“Conversion”). The Predecessor Fund previously charged a management fee of 40bps while the Fund now charges 60bps. The ODCE Index Fund’s performance prior to September 11, 2023, reflects a 40bps management fee and its performance on and after September 11, 2023, reflects a 60bps management fee. The performance shown reflects a continuation of performance from the Predecessor Fund to the ODCE Index Fund. While the ODCE Index Fund has a different investment adviser than the Predecessor Fund, the ODCE Index Fund’s portfolio management is substantially similar to the Predecessor Fund. The Conversion was a non-taxable event for existing shareholders.

Past performance is no guarantee of future results. Investing in the ODCE Index Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ODCE Index Fund’s investment objective is to employ an indexing investment approach that seeks to track the NCREIF Fund Index – Open End Diversified Core Equity (the “NFI-ODCE Index”) on a net-of-fee basis while minimizing tracking error. There can be no assurance that the actual allocations will be effective in achieving the ODCE Index Fund’s investment objective or delivering positive returns. It is not possible to invest in an index. You cannot invest directly in an index and unmanaged indices do not reflect fees, expenses, or sales charges. The ability of the ODCE Index Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the ODCE Index Fund’s assets across the various asset classes in which it invests and to select investments in each such asset class. There can be no assurance that the actual allocations will be effective in achieving the ODCE Index Fund’s investment objective or delivering positive returns. Limited liquidity is provided to shareholders only through the ODCE Index Fund’s quarterly repurchase offers for no less than 5% of the ODCE Index Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer.

An investment in the ODCE Index Fund represents an indirect investment in the securities owned by the ODCE Index Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The ODCE Index Fund is classified as a “non-diversified” under the Investment Company Act of 1940 and therefore may invest more than 5% of its total assets in the securities of one or more issuers. As such, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the ODCE Index Fund’s net asset value than in a “diversified” fund. The ODCE Index Fund is not intended to be a complete investment program. The ODCE Index Fund is subject to the risk that geopolitical and other similar events will disrupt the economy on a national or global level. For instance, war, terrorism, market manipulation, government defaults, government shutdowns, political changes or diplomatic developments, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and natural/environmental disasters can all negatively impact the securities markets.

The ODCE Index Fund will concentrate its investments in real estate industry securities. The value of the ODCE Index Fund’s shares will be affected by factors affecting the value of real estate and the earnings of companies engaged in the real estate industry. These factors include, among others: (i) changes in general economic and market conditions; (ii)changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing; (ix) climate change; and (x) changes in interest rates. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company’s operations and market value in periods of rising interest rates. The value of securities of companies in the real estate industry may go through cycles of relative under- performance and over-performance in comparison to equity securities markets in general. A significant portion of the ODCE Index Fund’s underlying investments are in private real estate investment funds managed by institutional investment managers that comprise the NFI-ODCE Index (“Eligible Component Funds”). Investments in Eligible Component Funds may pose specific risks, including: such investments require the ODCE Index Fund to bear a pro rata share of the vehicles’ expenses, including management and performance fees; the Adviser and Sub-Adviser will have no control over investment decisions made by such vehicle; such vehicle may utilize financial leverage; such investments have limited liquidity; the valuation of such investment as of a specific date may vary from the actual sale price that may be obtained if such investment were sold to a third party.

Additional risks related to an investment in the ODCE Index Fund are set forth in the “Risks” section of the prospectus, which include, but are not limited to the following: correlation risk, credit risk, fixed income risk, leverage risk, and risk of competition between underlying funds.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the ODCE Index Fund. This and other important information about the ODCE Index Fund is contained in the prospectus, which can be obtained online at accordantinvestments.com. The prospectus should be read carefully before investing. Investors should consult with their selling agents about the sales load and any additional fees or charges their selling agents might impose on each class of shares. For differences between the Class A shares and Class I shares, please see the prospectus of the Accordant ODCE Index Fund.

The Accordant ODCE Index Fund is distributed by ALPS Distributors, Inc (ALPS). Accordant Investments LLC is not affiliated with ALPS.

IMPORTANT FOOTNOTES AND DISCLOSURES REGARDING THE ACCORDANT REAL ESTATE GROWTH FUND

Currently, the Accordant Real Estate Growth Fund (the “Growth Fund”) is a private fund relying on the 3(c)(7) exemption of the Investment Company Act of 1940. The Growth Fund has filed an N-2 registration statement with the Securities and Exchange Commission (“SEC”) but is still awaiting comments from the SEC. Any offers and sales of interests in the Growth Fund are not registered under the laws of any jurisdiction and are made solely to qualified purchasers under applicable laws. An investor should consider the investment objectives, risks, charges, and expenses of the Growth Fund set forth in the subscription agreement of the Growth Fund carefully before investing. This communication is not an offer to sell Growth Fund shares and is not soliciting an offer to buy Growth Fund shares in any state where the offer or sale is not permitted.

The Growth Fund has limited operating history upon which prospective investors may evaluate its performance. The Growth Fund’s investment program should be evaluated on the basis that there can be no assurance that the Adviser’s assessment of the proposed investments will prove accurate or that the Growth Fund will achieve its investment objective. Past performance of any of the Adviser or Sub-Adviser’s other unrelated fund products is not necessarily indicative of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. There can be no assurance that the Growth Fund will achieve its targeted returns, diversification or asset allocations will be met, that the Growth Fund’s performance will track any benchmark, or that the Growth Fund will be able to implement its investment strategy and investment approach or achieve its investment objective. Actual returns on unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, legal and contractual restrictions on transfer that may limit liquidity, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the valuations used in prior performance data are based. Accordingly, actual returns may differ materially from stated returns.

The Growth Fund will concentrate its investments in real estate industry securities. The value of the Growth Fund’s shares will be affected by factors affecting the value of real estate and the earnings of companies engaged in the real estate industry. These factors include, among others: (i) changes in general economic market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding, and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values, or the appeal of property to tenants; (viii) the availability of financing; (ix) climate change; and (x) periods of rising interest rates. The value of securities of companies in the real estate industry may go through cycles of relative under-performance and overperformance in comparison to equity securities markets in general. Such statements involve known and unknown risks, uncertainties and other factors, and you should not place undue reliance on them.

Certain information herein is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. It may not be relied on in any manner, as legal, tax or investment advice, or as an offer to sell, or a solicitation of an offer to buy any product managed by Accordant. Accordant is not adopting, making a recommendation for, or endorsing any investment strategy or particular security or property mentioned in this content. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Accordant Investments, LLC (“Accordant”) cannot guarantee that the information herein is accurate, complete or timely. The information contained herein must be treated in a confidential manner and may not be reproduced, used or disclosed, in whole or in part, without the prior written consent of Accordant.

Past or projected performance is no guarantee of future results and not indicative of future results. Actual returns on unrealized investments will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, legal and contractual restrictions on transfer that may limit liquidity, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the valuations used in the prior performance data contained herein are based. All real estate investments have the potential for value loss during the life of the investment and the sponsor can make no assurances that any investment will achieve its objectives, goals, generate positive returns, or avoid losses.

Statements contained in this content that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Accordant. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this content may contain “forward-looking statements.” Certain economic and market information contained herein has been obtained from published sources prepared by third parties and in certain cases has not been updated through the date hereof. Accordant or its affiliates, nor any of their respective employees or agents assumes any responsibility for the accuracy or completeness of such information.

Accordant has not made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and they expressly disclaim any responsibility or liability, therefore Accordant does not have any responsibility to update or correct any of the information provided in this content.

By investing in the Fund, an investor is an investor solely in an Accordant fund and has no direct investor or client relationship with Affinius or Kandle, or any Affinius Fund or Kandle Fund, or any direct rights, including with respect to information or any communication, relating to Affinius or Kandle, or any Affinius Fund or Kandle Fund. Any information provided with respect to Affinius or Kandle, or any Affinius Fund or Kandle Fund is as of the date such information was provided to Accordant and is subject to subsequent events or developments which may materially change the information provided therein. Accordant bears sole responsibility with respect to providing any updated materials.

The Fund’s Adviser is Accordant Investments LLC. The Adviser is a wholly-owned subsidiary of Emphasis Capital LLC and was established in 2023. The Adviser is located at 6710 E. Camelback Rd., Suite 100, Scottsdale, AZ 85251. The Fund’s Sub-Adviser is IDR Investment Management, LLC (“IDR”). IDR, a registered investment adviser under the Advisers Act, serves as the sub-adviser to the Fund. IDR is an indirect majority-owned subsidiary of Emphasis Capital LLC. This Presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service managed by Accordant.