September 23, 2022

Public or Private? You have a choice when investing in real estate.

When Dwight David Eisenhower signed the Cigar Excise Tax extension in 1960, he created a structure...

As an advisor, you're well aware of the growing interest in alternative investments, or "alts," which have been increasingly playing an important role in portfolio construction among advisors seeking to diversify their clients' portfolios. In this blog, we look closer at the world of alternative investments and discuss why the private real estate asset class has been slow to gain the same momentum as other private strategies.

A brutal year for stocks and bonds in 2022 and the tepid recovery the following year have sent many advisors in search of non-traditional asset classes that can help stabilize clients’ portfolios and be another source of income and return. How strong is this interest in alts?

“Amid ongoing market volatility and tightening monetary policy, nearly nine in 10 financial advisors (88%) intend to increase their allocations to alternative asset classes over the next two years, according to a recent independent survey conducted by CAIS and Mercer.” - caisgroup.com Nov. 2022

Alternative investments encompass a wide range of asset classes, including hedge funds, private equity, private credit, and real assets. As a group, they offer advisors compelling options because they generally have low correlations to traditional publicly traded securities asset classes and aren’t subject to the same movements and influence of the public markets.

Next to the private credit market, private real estate represents the second largest sector of private alternative assets, but surprisingly, it doesn’t get much attention, which indicates many advisors are missing out on the potential benefits it can offer.

Private real estate is a powerful alternative investment option that involves investing in a wide range of institutional-quality properties and with a host of different strategies to meet specific client objectives. Also, since most of these funds are managed by experienced sponsors, they offer your clients real estate exposure in a passive format with no hands-on management responsibilities.

However, the lack of attention to private real estate can be attributed to several issues that advisors have found problematic for years.

Private real estate offers several potential advantages, including the potential for durable income, diversification in your clients' portfolios, and the opportunity for long-term capital appreciation.

Historically, private real estate investments have demonstrated the ability to provide attractive returns. When owned and managed effectively, funds with premium-quality properties can offer the potential for significant appreciation over time.

To take its rightful place and earn a proper allocation in advisors’ client portfolios, IDR Investment Management set out several years ago to create a private real estate fund that could overcome the advisor objections mentioned earlier. After years of product development and ultimately securing a patent on the firm’s management process, IDR and its partner firm, Accordant Investments, combined their expertise to offer retail investors the Accordant ODCE Index Fund (“Fund”).

This Fund is designed to give your clients exposure to private real estate investments without the complexities of direct property management. The Fund also tackles the issues of illiquidity, transparency, and high fees by providing a diversified, professionally managed portfolio of private real estate assets in a cost-efficient index structure.

The Fund seeks to track the NCREIF Fund Index – Open End Diversified Core Equity (“NFI-ODCE Index”) on a net-of-fee basis while minimizing tracking error. The NFI-ODCE Index has been tracking the market performance of core private real estate for the past 45 years and today is considered to be among the most comprehensive indexes in the industry.

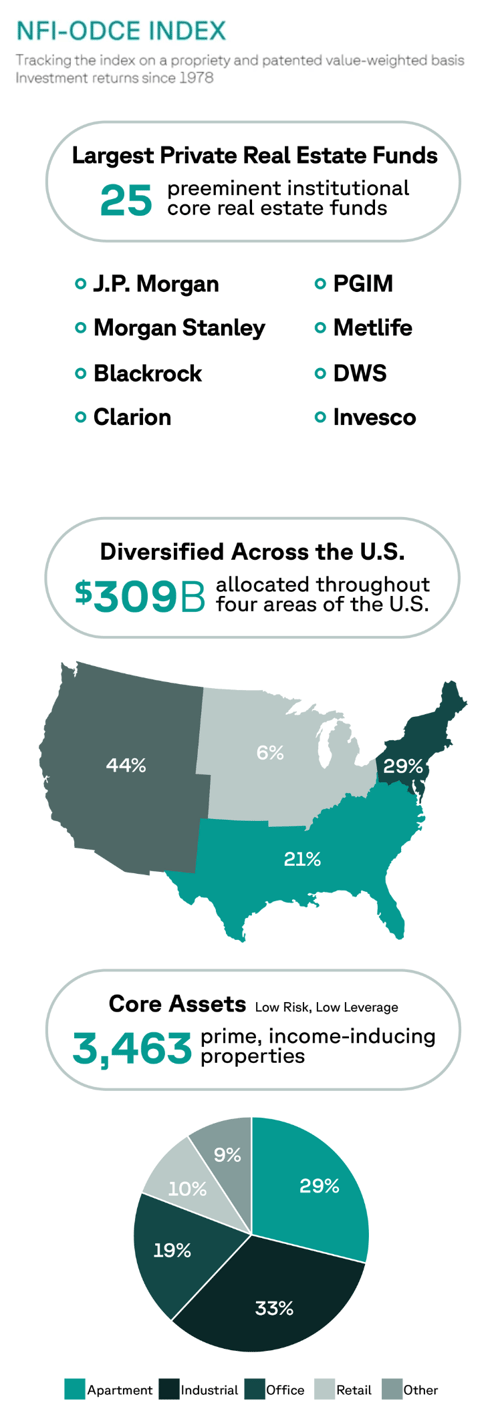

This illustration helps provide a view of the quality and breadth of the NFI-ODCE Index.

Example firms managing NFI-ODCE Component Funds. NFI-ODCE Index AUM given on a GAV basis. Figures updated Q3 2023. There are only a limited number of Eligible Component Funds that comprise that NFI-ODCE Index in which the fund seeks to track. One cannot invest in an index.

Many advisors are recognizing that in today’s environment, embracing alternative investments is crucial to achieving a greater level of portfolio diversification with a focus on mitigating risk. While alternative investments have gained popularity among a majority of investment advisors, private real estate remains an often-overlooked asset class.

The Accordant ODCE Index Fund provides a seamless solution to address historical investment advisor objections, making private real estate more accessible and attractive than ever before. To learn more, visit us at www.accordantinvestments.com and explore our vast library of advisor resources.

Accordant Investments LLC (“Accordant”) is an SEC registered investment adviser. This presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service managed by Accordant.

The Fund currently offers Class A Shares, Class I Shares and Class Y Shares which will all be continuously offered at the Fund’s net asset value (“NAV”) per share, plus, in the case of Class A Shares, a maximum sales load of up to 5.75%, from which a dealer-manager fee of up to 0.75% of offering proceeds may also be paid. Holders of Class A Shares, Class I Shares, and Class Y Shares have equal rights and privileges with each other, except that Class I Shares and Class Y Shares do not pay a sales load or dealer manager fees. See “Ongoing Distribution and Servicing Fees” and “Summary of Fund Expenses” for information on servicing and distribution fees in the Prospectus. Class I Shares and Class Y Shares are each not subject to a sales load; however, investors could be required to pay brokerage commissions on purchases and sales of Class I or Class Y Shares to their selling agents. Inception date of the Class I Shares is September 11, 2023 and Class A Shares is November 1, 2023.

The Accordant ODCE Index Fund (the “Fund”) was previously registered as the IDR Core Property Index Fund, Ltd. (the “Predecessor Fund”). The Fund’s investment adviser is Accordant Investments LLC (“Adviser”) and Fund’s sub-advised by IDR Investment Management LLC (“Sub-Adviser”). The Predecessor Fund was a quarterly valued closed-end tender offer fund only available to accredited investors. Pursuant to a proxy filed with SEC and a special shareholder meeting that occurred on August 31, 2023, the Predecessor Fund converted into the Fund which is a daily valued registered closed-end interval fund (“Conversion”). The Predecessor Fund previously charged a management fee of 40 bps while the Fund now charges 60 bps. Fund performance shown in this presentation is net of fees and for performance prior to September 11, 2023, reflects a 40 bps management fee and for performance on and after September 11, 2023, reflects a 60 bps management fee. The performance shown reflects a continuation of performance from the Predecessor Fund to the Fund. While the Fund has a different investment adviser than the Predecessor Fund, the Fund’s portfolio management is substantially similar to the Predecessor Fund. The Conversion was a non-taxable event for existing shareholders.

Past Performance is No Guarantee of Future Results.

Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The Fund’s investment objective is to employ an indexing investment approach that seeks to track the NCREIF Fund Index – Open End Diversified Core Equity (the “NFI-ODCE Index”) on a net-of-fee basis while minimizing tracking error. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. It is not possible to invest in an index. You cannot invest directly in an index and unmanaged indices do not reflect fees, expenses, or sales charges.

The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the Fund’s assets across the various asset classes in which it invests and to select investments in each such asset class. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. The first repurchase offer following the Conversion is expected to occur in February 2024.

An investment in shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The Fund is “non-diversified” under the Investment Company Act of 1940, and therefore may invest more than 5% of its total assets in the securities of one or more issuers. As such, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund’s net asset value than in a “diversified” fund. The Fund is not intended to be a complete investment program.

The Fund is subject to the risk that geopolitical and other similar events will disrupt the economy on a national or global level. For instance, war, terrorism, market manipulation, government defaults, government shutdowns, political changes or diplomatic developments, public health emergencies (such as the spread of infectious diseases, pandemics, and epidemics), and natural/environmental disasters can all negatively impact the securities markets.

The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. Potential impacts on the real estate market may include lower occupancy rates, decreased lease payments, defaults, and foreclosures, among other consequences. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown.

The Fund will concentrate its investments in real estate industry securities. The value of the Fund’s shares will be affected by factors affecting the value of real estate and the earnings of companies engaged in the real estate industry. These factors include, among others: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding, and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values, or the appeal of property to tenants; (viii) the availability of financing; (ix) climate change; and (x) changes in interest rates. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company’s operations and market value in periods of rising interest rates. The value of securities of companies in the real estate industry may go through cycles of relative under-performance and over-performance in comparison to equity securities markets in general.

A significant portion of the Fund’s underlying investments are in private real estate investment funds managed by institutional investment managers that comprise the NFI-ODCE Index (“Eligible Component Funds”). Investments in Eligible Component Funds may pose specific risks, including: such investments require the Fund to bear a pro rata share of the vehicles’ expenses, including management and performance fees; the Adviser and Sub-Adviser will have no control over investment decisions may by such vehicle; such vehicle may utilize financial leverage; such investments have limited liquidity; the valuation of such investment as of a specific date may vary from the actual sale price that may be obtained if such investment were sold to a third party.

Additional risks related to an investment in the Fund are set forth in the “Risk Factors” section of the prospectus, which include, but are not limited to the following: convertible securities risk, correlation risk, credit risk, fixed income risk, leverage risk, and risk of competition between underlying funds.

Investors should consult with their selling agents about the sales load and any additional fees or charges their selling agents might impose on each class of shares.

The Accordant ODCE Index Fund is distributed by ALPS Distributors, Inc (ALPS). Accordant Investments LLC is not affiliated with ALPS.

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Accordant ODCE Index Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained online by visiting www.accordantinvestments.com. The prospectus should be read carefully before investing. For differences between the Class A Shares and Class I Shares, please see the prospectus of the Fund.

September 23, 2022

When Dwight David Eisenhower signed the Cigar Excise Tax extension in 1960, he created a structure...

February 14, 2024

As an investment adviser, you know how an ever-evolving investment landscape influences the...

October 6, 2022

Private real estate is drawing increasing interest from investment advisors As an investment...