According to a study by research firm Chatham Partners, 83% of advisors in the U.S. recommend REITs to their clients, and the most commonly cited reason is “portfolio diversification.”1 Yet, despite the asset class's popularity, many advisors remain confused about how much of a client’s portfolio to allocate to real estate.

A small allocation to public REITs may be insufficient to achieve the desired diversification benefits real estate can provide. A recent Morningstar study suggests the optimal allocation to REITs ranges between 4% and 13%, depending on the investor’s risk tolerance and time horizon.

A Balanced Allocation: Public and Private Real Estate

Considering the propensity for advisors to recommend public REITs to their clients, adding a private real estate allocation could help achieve even greater portfolio diversification and potentially improve risk-adjusted returns.

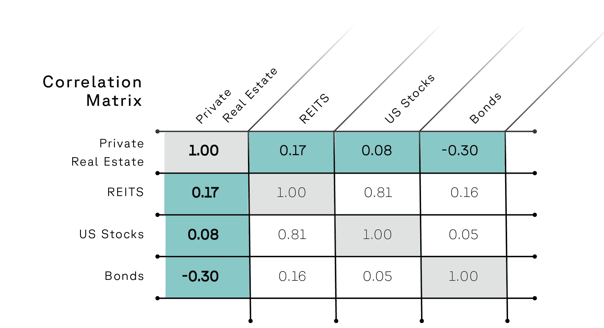

As this chart illustrates, a “core” private real estate strategy has had a low correlation to publicly-traded securities (including REITs). This may help provide more stabilized income and total returns since private real estate historically has not fluctuated in the same direction and magnitude as the public markets.

15-year Correlation of Total Returns for All Asset Classes

Through Q4, 2022

Source: NFI-ODCE Index (private real estate), FTSE Nareit Equity REITs, S&P 500 (U.S. stocks), Bloomberg Barclays U.S. Aggregate Bond Index (bonds). Past performance is not indicative of future results.

In addition, as a leading indicator of the real estate market subject to equity market sentiment, public REITs behave differently than private real estate investments. REIT prices can be subject to wider swings and may be higher or lower than the valuation of underlying real properties. Conversely, changes in valuations of the underlying properties are generally driven by changes in fundamentals (e.g., net operating income, long-term interest rates) rather than market sentiment, so while returns may be lower than REITs at times, private real estate has tended to be less volatile.

Combined, these different characteristics of public REITs and private real estate can help provide your clients with a more “balanced” real estate allocation.

How to Allocate to Private Real Estate

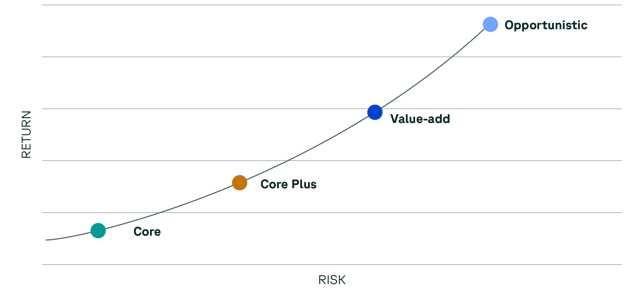

You may be less familiar with private real estate investments than public REITs. Broadly, four primary investment strategies describe the commercial real estate investment spectrum. While all real estate investments carry risk, their risk-return characteristics make it easier for you to allocate to your clients’ different risk tolerances.

As the chart below illustrates, each strategy is designed to meet different investment objectives for a range of different risk/return characteristics. Understanding these characteristics can help you determine the most suitable strategy for a given client.

Core

Core real estate is generally considered the most conservative private real estate investment strategy. As a result, it may be most suitable for clients with longer-term investment horizons or those looking to receive consistent cash flow distributions. Core properties are often located in stable, developed markets and have long-term leases with established credit-worthy tenants.

Many advisors view a core real estate investment as complementary to a client’s income or bond allocation.

Core Plus

Core plus property investments have slightly higher risk characteristics than core but may offer higher return potential. Properties are usually high quality and generally occupied by quality tenants. However, certain assets may require minor upgrades and improvements, enabling owners to increase cash flows as leases expire and new tenants are secured.

Core plus property investments may be most appropriate for clients seeking income and growth.

Value Add

Value add investments are characterized by properties that may be in good locations but are older and in significant need of physical improvements and renovation. Value add investing aims to purchase aging properties at a reasonable price and “create value” by making upgrades and managing the properties more efficiently.

Value add investments are more suitable for clients with a high-risk tolerance, seeking growth in their investment portfolios, and not needing immediate cash flow.

Opportunistic

Opportunistic investment properties have the least predictable cash flows but offer the highest return potential. Properties may be completely vacant, needing massive repairs or even total repositioning. Opportunistic investments can include underdeveloped raw land or complete ground-up development.

Due to the long time horizons required to develop opportunistic properties, these investments are most appropriate for clients seeking the greatest returns and with no need for liquidity.

So, recognizing these strategies are designed to meet the investment objectives of different investor profiles from conservative to aggressive, you now have a better understanding of where to reduce portfolio allocations – either bonds or stocks – to make room for a private equity sleeve.

Making a Difference

It is no surprise that RIAs are increasingly looking to non-traditional asset classes to help strengthen client portfolios from the volatility of the public markets. In a recent study by Cerulli, most of the surveyed advisors indicated they intend to increase client exposure to alternatives to an average of 17.5% within the next two years. And private real estate represents an asset class that historically has delivered on many of the objectives advisors are seeking: diversification, inflation protection, potentially attractive risk-adjusted returns, and current income.

Discover how a private real estate allocation can potentially help improve portfolio outcomes for your clients. Download our guide, Why Private Real Estate - An Unconventional Truth.

---

Sources:

1 https://www.reit.com/news/blog/market-commentary/new-morningstar-analysis-shows-optimal-allocation-reits