To say 2022 was a challenging year for advisors and their clients would be an understatement. The Federal Reserve’s aggressive rate-hike plan to curb persistently high inflation, and genuine concerns about a potential recession created a level of investor anxiety not likely seen since the Great Recession.

With stocks down approximately 19% and bonds off over 12% for the year, advisors struggled to find a delicate balance between protecting client portfolios from further loss and allocating to investments that can still provide some measure of durable income and growth. Private real estate is one asset class capable of helping meet those objectives, and advisors are taking notice.

The Appeal of Private Real Estate

Although advisors may be unfamiliar with private real estate markets, many are attracted to the asset class because of the different benefits it can provide in constructing client portfolios..

First, as a non-publicly traded investment, private real estate has a low correlation to stocks and bonds and isn’t generally subject to the influences and movements of public markets, which helps provide true diversification to a portfolio.

Second, private real estate has historically proven to be an effective inflation hedge because property owners can generally raise rents to keep pace with rising operating costs.

Third, many advisors find private real estate appealing because they can select from a range of investment styles to meet different client objectives and risk tolerance profiles.

Lastly, private real estate can provide investors with a durable source of income that has historically been higher than REITs, U.S. stocks and bonds.

Strategies For All Risk Tolerance Levels

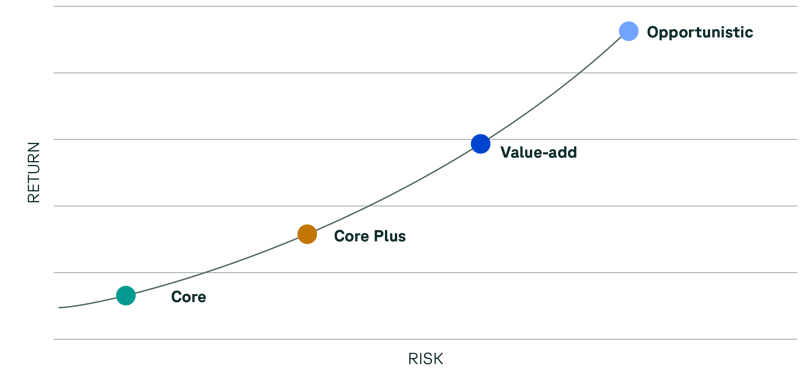

Private real estate strategies span the investment risk spectrum and enable you to help meet your clients' income and growth objectives. Strategies include Core, Core-Plus, Value-Add, and Opportunistic.

Core

Core strategies serve a role similar to traditional fixed-income investments. Core real estate can offer income and attractive risk-adjusted returns for investors with longer time horizons. Core properties are typically high quality and fully stabilized with low leverage and long tenant leases. Trophy properties in central business districts of major cities are typical core properties and are less sensitive to market and economic volatility than higher-risk strategies.

Core-Plus

Core-plus is also considered a strategy similar to fixed-income investments but may have a greater potential for capital appreciation than “core” investments. Quality properties with minor upgrade requirements are the hallmark of core-plus real estate. Prudent leverage can enhance returns with a controlled increase in risk. Property owners will attempt to increase cash flows through minor improvements, increasing tenant quality, restructuring lease rollover schedules, or improving management efficiencies.

Value-Add

A value-add strategy is akin to an equity manager's approach to investing in stocks they believe are undervalued or trading below intrinsic value. Improving or redeveloping property to enhance its use and value is key to value-add. To reach full value, assets in this category need help. Problems to solve include deferred maintenance, below-market occupancy or lease rates, or substandard facilities needing significant improvement. Value-add managers will use higher leverage levels to drive returns, pushing the strategy further out the risk spectrum from core and core-plus.

Opportunistic

Opportunistic real estate is comparable to an aggressive growth strategy in the equity markets. While opportunistic real estate offers the least predictable cash flows, the strategy provides the potential for the highest returns. The focus is on ground-up development, rehabilitation, and distressed properties and loans. Opportunistic strategies typically pursue assets with limited or no current rental income. A large portion of returns will come from capital appreciation upon a sale. Opportunistic properties will generally use significant leverage to magnify returns. Opportunistic is the most aggressive and risky of the private real estate strategies.

Best of Both Worlds?

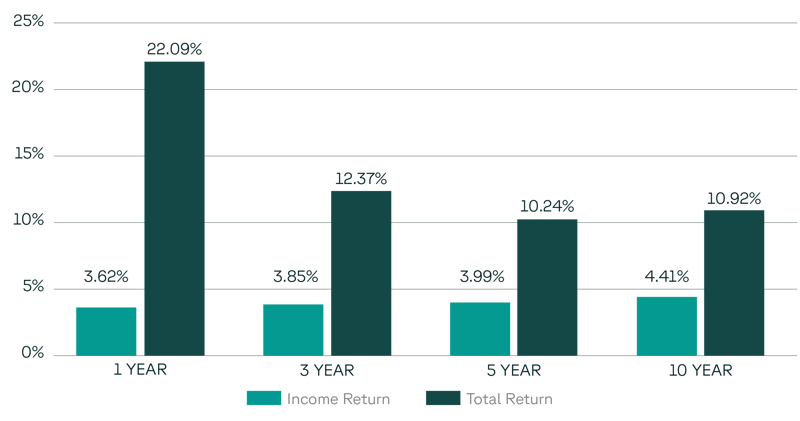

For your clients whose investment objectives include income and growth, a core private real estate strategy may be appropriate. While core investments are typically pursued by income-oriented investors, these strategies can also deliver some capital appreciation as you can see in this chart where core private real estate performance is represented by the NFI-ODCE Index.

Source: IDR, NCREIF-ODCE. Annualized gross total returns and income through Q4 2022. Performance is not a guarantee of future results. Index returns are before management and other fees and expenses. An investor cannot invest directly in an index.

If you’d like to learn more about how a private real estate allocation can potentially enhance the overall performance of a traditional stock and bond portfolio, download our complimentary guide, Building a Better 60/40 Portfolio with Core Private Real Estate.