Commercial real estate has been a staple allocation among institutional investors for over 50 years. Many of those investors have focused heavily on private real estate because of its diversification characteristics and low correlation to publicly-traded securities.

Advisors Take Notice

Today, private real estate is gaining wide attention among financial advisors for the same potential benefits as the traditional 60/40 stock and bond portfolio continues to be buffeted by an array of economic and market challenges. Just consider:

- Inflation remains near a 40-year high and is expected to continue.1

- Stocks were off about 19%, and bonds off 15% for the year through October.2

- Heavy market volatility is expected to extend into 20233

- S&P earnings estimates for 2023 have made a complete u-turn as recession risk looms4

These issues may increase investor anxiety, which often could lead to poor, emotionally driven investment decisions. You have undoubtedly needed to serve as a calm counselor to many of your clients this year. Let’s also look at how allocating to private real estate may help stabilize your clients’ portfolios and potentially improve risk-adjusted returns.

A Core Complement to Stocks and Bonds

Private real estate investing has evolved to what is now an opportunity set that offers investors a range of investment options across the risk-reward spectrum. Investments range from conservative income-oriented funds to more speculative approaches focusing on capital appreciation.

Some strategies, specifically “core” investments, which have long been a preferred investment approach for institutions, can sit nicely between fixed-income and equity allocations in a client’s portfolio. Core properties are typically higher quality, fully stabilized buildings with low leverage and established, credit-worthy tenants secured by long tenant leases.

Core in Portfolio Construction

Considered the most conservative real estate strategy, many advisors believe an investment in core real estate is most suitable for income-oriented investors with longer investment horizons. Some use core real estate investments to complement a client’s bond allocation, particularly in a rising interest rate environment when bonds are exposed to duration risk.

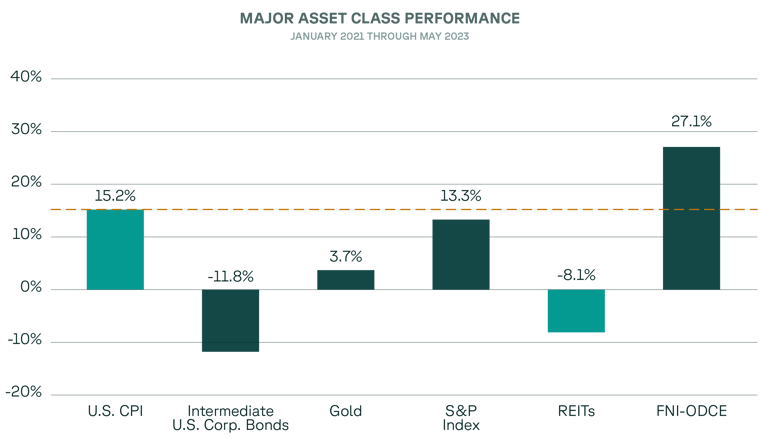

In addition to being a source of stable income, core investments can also generate capital appreciation in a client’s portfolio. As the chart below illustrates, during periods of rising inflation and limited supply, as we have experienced the last two years, private real estate can outperform many other asset classes (as represented by the NFI-ODCE Index, a proxy for core private real estate).

Sources: Bloomberg LP, Affinius Capital Indices: Intermediate U.S. Corporate Bonds are Barclays Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index. This represents historical patterns utilizing varying analytical data. It is not representative of a projection of any specific investment. An investor cannot invest directly in an index. Accordant Investments does not expect NFI-ODCE to continue to deliver this type of outperformance.

So, as an asset class that can provide equity-like characteristics, core private real estate can potentially improve a portfolio’s risk-return performance because it generally offers:

- Low correlation to stocks, bonds, and public REITs

- Historically strong risk-adjusted returns

And as a more conservative income-oriented investment strategy akin to a portfolio’s bond allocations, private real estate can serve as:

- An alternative source of durable income

- An effective inflation hedge in rising-price environments

What is an Appropriate Allocation?

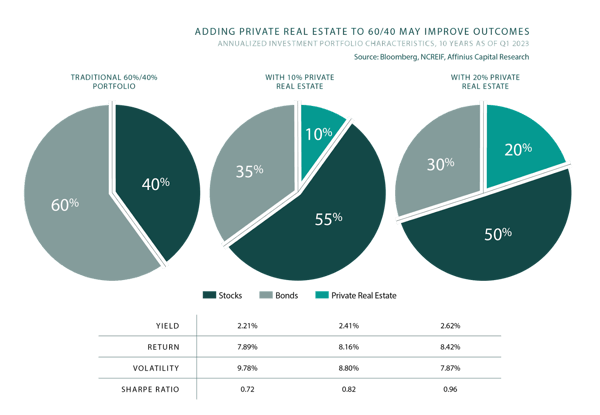

Data suggest that adding a 10% or 20% allocation of core private real estate to a traditional 60/40 stock and bond portfolio may be a productive approach to portfolio enhancement. Historically, adding core private real estate increases income, reduces volatility, and enhances Sharpe ratios while maintaining long-term returns.

Adding Private Real Estate to a 60/40 Portfolio May Improve Outcomes

Annualized Portfolio Characteristics; 10 years as of Q1 2023

Source: Bloomberg, NCREIF, Affinius Capital

---

Sources & Important Disclosures:

1 https://www.cnbc.com/2022/11/09/cpi-inflation-numbers-expected-to-remain-highwhat-to-know.html

2 https://www.morganstanley.com/ideas/bear-market-2022-two-metrics

3 https://www.businessinsider.in/stock-market/news/heavy-stock-market-volatility-should-run-into-2023-as-investors-gauge-whether-the-economy-will-have-a-soft-or-hard-landing-says-ubs/articleshow/95388073.cms

4 https://www.marketwatch.com/story/s-p-500-earnings-estimates-for-2023-take-complete-u-turn-as-recession-risks-loom-according-to-bofa-11667843447

Important Disclosures:

The information contained in this Presentation is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, an interest (“Interest”) in a fund or other investment vehicle (collectively as applicable, a "Fund") by IDR Investment Management, LLC, (“IDR IM”) or their affiliates and subsidiaries.

The information contained herein is subject to change, and may not be reproduced, used or disclosed, in whole or in part, without the prior written consent of IDR-IM.

Statements contained herein are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Firm. Such statements involve known and unknown risks, uncertainties and other factors, and you should not place undue reliance on them. Additionally, “forward-looking statements” may be referenced. Actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements.

Certain economic and market information has been obtained from published sources prepared by third parties and in certain cases has not been updated through the date of the Presentation. Neither IDR-IM nor their respective affiliates nor any of their respective employees or agents assumes any responsibility for the accuracy or completeness of such information. The IDR Entities have not made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and they expressly disclaim any responsibility or liability for this information. IDR-IM and the IDR Entities do not have any responsibility to update or correct any of the information provided herein.