If 2022 is teaching investors anything, it's that market volatility is a way of life, and patience is the order of the day. Chances are, you've received more than a few calls from exasperated clients fatigued by watching their investment portfolios get whipsawed month after month.

We discussed how our rising rate environment exposes bonds to duration risk and negative returns in our earlier post. Similarly, markets reacting to Federal Reserve actions designed to slow inflation can send stocks on a rollercoaster of daily swings greater than 2%. That volatility can not only be troubling for your clients; it can become a drag on portfolio performance.

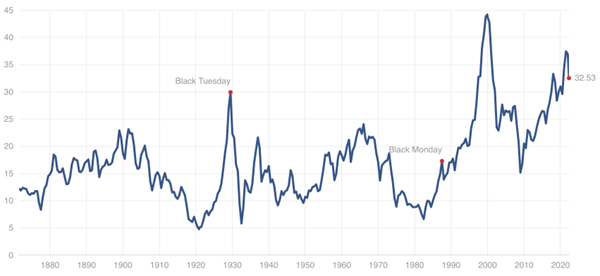

High Valuations Could Spell Danger

It's not just bonds that pose challenges for the 60/40 stock/bond model portfolio. Stock market valuations have attained risky heights after a long bull market and more than a decade of central bank stimulus. In fact, equity valuations in 2021 reached levels only exceeded in the speculative top that preceded the "Tech Bust" of 2000 to 2002, measured with the Cyclically Adjusted Price Earnings ratio or CAPE ratio of Nobel Prize-winning Yale Professor Robert Shiller.

Risky Heights

Shiller Cyclically Adjusted PE “CAPE” Ratio

1872 to 2022

Source: multpl.com

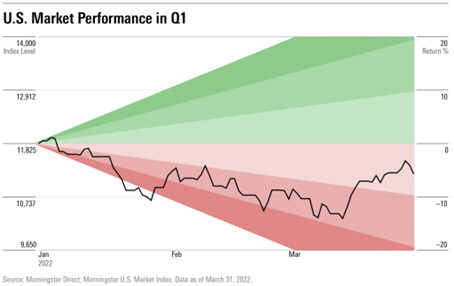

2022 got off to a rough start as investors grappled with high stock valuations and the unknown impacts of rising rates and persistent inflation on their investment portfolios, as noted by Morningstar.

"U.S. stocks lost ground during the first quarter of 2022, finishing down 5.3% – making for the worst start to the year since the coronavirus pandemic in the first quarter of 2020." - morningstar.com

Source: morningstar.com

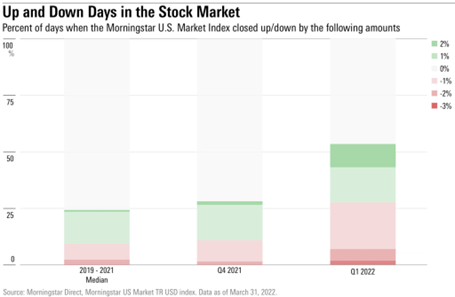

Beyond the market decline, the spike in daily volatility has been a source of anxiety for investors. The number of days when equity markets moved up or down in excess of +/- 1% more than doubled in the first quarter when compared to the average of the last three years. The -3.1% decline on March 7 and -3.6% decline on April 29 were the worst days for equities since the pandemic-driven plunge of March 2020.

"In the stock market, that volatility showed itself in the number of big up or down days, where the quarter was over twice as volatile as the median quarter over the past three years." - morningstar.com April 1, 2022

Heightened Market Volatility

Source: morningstar.com

The Fed Effect

Perhaps what has the markets spooked the most is trying to price in how the economy and corporate profits will be impacted by Fed action. As noted in a Forbes article heading into the second quarter of 2022, the Fed’s use of rate hikes to curb inflation is uncharted territory when the economy is not overheating.

“The Fed is navigating a dangerous monetary policy environment. Historically, it has tried to “tighten the screw” on interest rates when the economy is overheating, and inflation is rising—but only inflation is the only problem presently, notes Fall Ainina, director of research at James Investments.” - Forbes.com

Reducing Portfolio Volatility

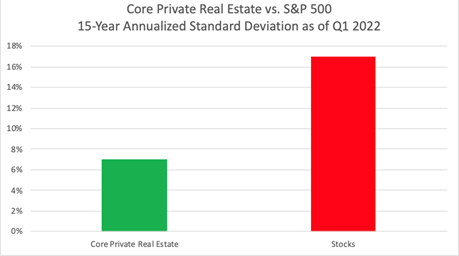

An allocation to core private real estate may help reduce overall portfolio volatility due to its historic near-zero correlation to stocks. In addition, core private real estate has historically exhibited only 40% of the volatility of equities as indicated by the historical returns ..

Source: NFI-ODCE Index (“NFI-ODCE”) and S&P 500 (“Stocks”). 15-Year annualized data for all asset classes are shown gross of any investment management advisory fees as of 1Q 2022. Standard deviation (risk) is a measure of the volatility or dispersion of historical returns around their central tendency or mean return. Past performance is no guarantee of future results. The NFI-ODCE index is not directly investable.

A Closer Look

Historically, core private real estate has delivered consistent and reliable income and total returns over both short and extended periods. These return characteristics enhance the appeal of core private real estate as a portfolio diversifier and as a complement to an equity allocation.