What a difference a few years make. Many investors had come to expect the low interest rate environment that had buoyed bond returns and overall portfolio performance up to the onset of the pandemic might last forever. But all good things come to an end, and the 40-year run of the bond bull market is living proof.

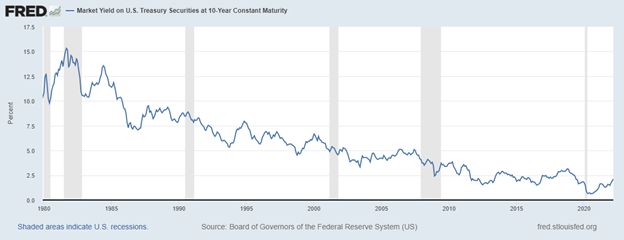

From 1981 to 2020, bond yields slid from lofty mid-teens to under 1%, providing unexpected appreciation and (declining) income. The bond bull market that rewarded investors for four decades appears to be over, with bellwether bond indices posting negative returns in 2021 and 2022. And in 2022, we witnessed the most significant drawdown on record for global bonds, according to Bloomberg.

The sources of the recent negative bond market returns were historically low yields and increasing duration risk. Now, as the Fed raises interest rates to combat rising inflation, yields are increasing, and bond prices are falling. As a result, the strong returns that bonds contributed to the 60/40 model portfolio for decades are becoming a fading memory.

Bond Yields: Nowhere to Go but Up

10-Year Treasury Yields (Jan. 1980 - Mar. 2022)

When the overnight yield on the 10-year Treasury fell to 0.398% in March 20201, many observers thought yields could only go up. And for a few days in early May, the yield on the 10-year Treasury closed above 3%, exposing bondholders to duration risk. The media quickly took notice, and the evidence was startling.

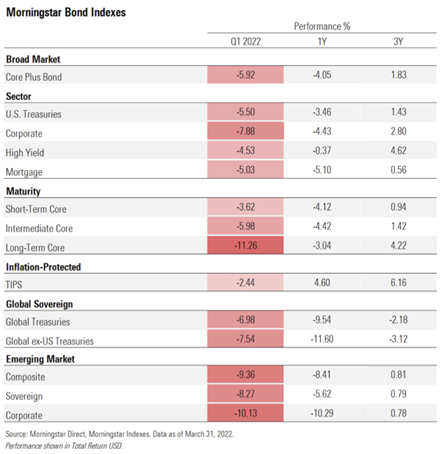

“Bond Market Suffers Worst Quarter in Decades

Rout has robbed investors of traditional haven as stocks and many other markets swing sharply.” - WSJ.com; March 31, 2022

“Treasuries Are Getting Crushed. It Might Continue for a Long Time. The selling in bonds could keep going for a long time. First off, a multidecade bull market in Treasury bonds looks to have ended.” - Barron's.com; March 29, 2022

A Sea of Red

Q1 2022 Fixed Income Returns

Source: morningstar.com

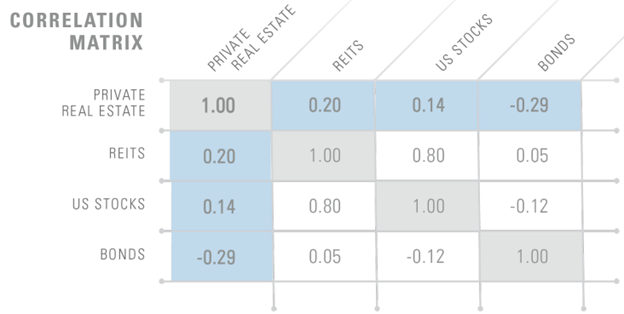

Stocks and Bonds in Lock-Step

We mentioned in our previous post that stocks have generally had a low correlation to bonds since the 1980s, enabling each security to serve its intended role in a balanced portfolio. But recent bond market losses coinciding with a significant equity market decline are cause for concern when considering the outlook for 60/40 returns in coming years:

"You can't look at something that has worked well for the past 30 years and expect it will continue," said Jean Boivin, head of BlackRock Investment Institute… - Bloomberg.com; December 7, 2021

A Place to Turn for Balance

With bonds under pressure, what other solutions can income investors explore? Historically uncorrelated to bonds, core private real estate can help offset the duration risk of fixed-income securities while providing competitive income. In fact, core private real estate has exhibited negative correlation to bonds over the past 15 years. In other words, core private real estate has tended to rise when bonds fall.

Core Private Real Estate: Uncorrelated Returns

15 Years Through Q1 2022

Source: NFI-ODCE Index (U.S. private real estate), FTSE Nareit Equity REITs (U.S. equity REITs), S&P 500 (U.S. stocks), Bloomberg Barclays U.S. Aggregate Bond Index (bonds) and Vanguard Total International Stock Index Fund Investor Shares (VGTSX) (international stocks). 15-year correlation of total returns for all asset classes as of Q1, 2022. Past performance is not indicative of future results.

As a potential complement to fixed income, core private real estate has generally exhibited a similar risk/return profile but with higher and uncorrelated total returns and only a modest increase in volatility.

Also, core private real estate has historically served as an attractive source of durable income, with higher yields than bonds, stocks, and even REITs over the previous 15 years.

Source: NFI-ODCE Index (private real estate), FTSE Nareit Equity REITs (REITs), Bloomberg Barclays U.S. Aggregate Bond Index (bonds), S&P 500 (U.S. stocks). 15-year annualized income returns for all asset classes. Data as of Q1 2022. Past performance is not indicative of future results. The NFI-ODCE Index is not directly investable.

The Next Step

We encourage you to take a closer look at how effective core private real estate might be in diversifying a traditional stock and bond portfolio. Download our newest guide, Building a More Balanced Portfolio, and discover the other potential advantages of allocating to this asset class which is drawing increasing interest among advisors.

---

1https://www.cnbc.com/2020/03/09/10-year-treasury-yield-plunges.html