If you have clients over 60 years of age, they likely have vivid memories of the financial pain inflicted by runaway inflation in the 1970s. The numbers were staggering. From 1971 to 1980, the average annual inflation rate was 8.21%, and consumer prices on many products doubled during those ten years.1 Red meat prices shot up in the first quarter of 1973 at an annual rate of 90%,2 and gasoline prices jumped from .36/gallon to $1.19.3

It took a draconian effort to slow the assault on consumers’ pocketbooks, which happened when Federal Reserve Chairman, Paul Volker, raised interest rates to 20% in the early 1980s.4 So yes, many of your clients remember not only out-of-control 70s inflation but also the 18% mortgage rate they had on their first home in the early 80s!

Another lost decade?

So the question today is, with a recent spike in prices that consumers are feeling at the gas pump, grocery store, and with home valuations, could it possibly get as nasty and last as long as what many investors remember as the lost decade of the 70s?

In short, nobody knows. There are similarities between our current economic situation and that of 50 years ago, but there are striking differences. For example, the Fed pursued an easy money policy in both periods to spur economic activity by keeping interest rates low. And today’s constrained supply chains, and increases in commodity prices are eerily similar to the 70s.2

On the other hand, the financial measures and government stimulus programs enacted to help the country rebound from the COVID-19 pandemic are far greater than anything considered in the 70s. Also, the more than nine million current job openings as of July 2021 are poised to fuel wage increases and pent-up spending demand that wasn’t present in the 70s.2

Hope for the best. Prepare for the worst.

Since nobody can accurately predict the degree or extent of a potential sustained inflationary environment, many of your clients may take a wait-and-see approach with their investment portfolios before making any significant changes.

However, for those clients who prefer a proactive approach to addressing inflation, there are a few investment strategies that historically have proven to be successful hedges in rising price environments. These include gold, commodities, Treasury inflation-protected securities (TIPS), and real estate.

We believe real estate, particularly commercial real estate (CRE), is worth a closer look as an effective inflation hedge.

CRE to the rescue?

Many investment advisors look to commercial real estate as a promising strategy during times of rising inflation. And those who allocate a portion of their clients’ investment portfolios to commercial real estate when inflation spikes have historically fared better than those who simply own stocks and bonds. Here’s why:

- Owners of commercial property assets like office, retail, and multi-family typically structure leases with rent escalation clauses enabling them to increase rents along with increases in the Consumer Price Index.

- Commercial real estate is considered a necessity asset, encompassing the properties where we shop, work, and live (apartments), so it generally holds its intrinsic value even during periods of market volatility.

- Commercial real estate is considered by many to be a compelling alternative source of income, especially at times when prices on goods and services are rising quickly. Inflation effectively erodes the yields on investment-grade bonds, which remain at historically low levels.

The private advantage

As you know, there are many ways to invest in real estate, with the easiest being owning shares of publicly traded REITs, real estate mutual funds, or ETFs. Private real estate investments, however, may provide an added advantage in rising price environments.

Publicly traded real estate securities are widely considered to be an uncorrelated asset to stocks and bonds. But there can be periods when they perform quite similarly to the equity markets and thus, become more exposed to inflation’s erosive influence on returns.

Private real estate is not subject to that same market influence. In fact, certain types of private real estate funds that own trophy, institutional-quality properties may outperform during periods of rising prices due to the quality of their tenants, length of their leases, and strength of their balance sheets.

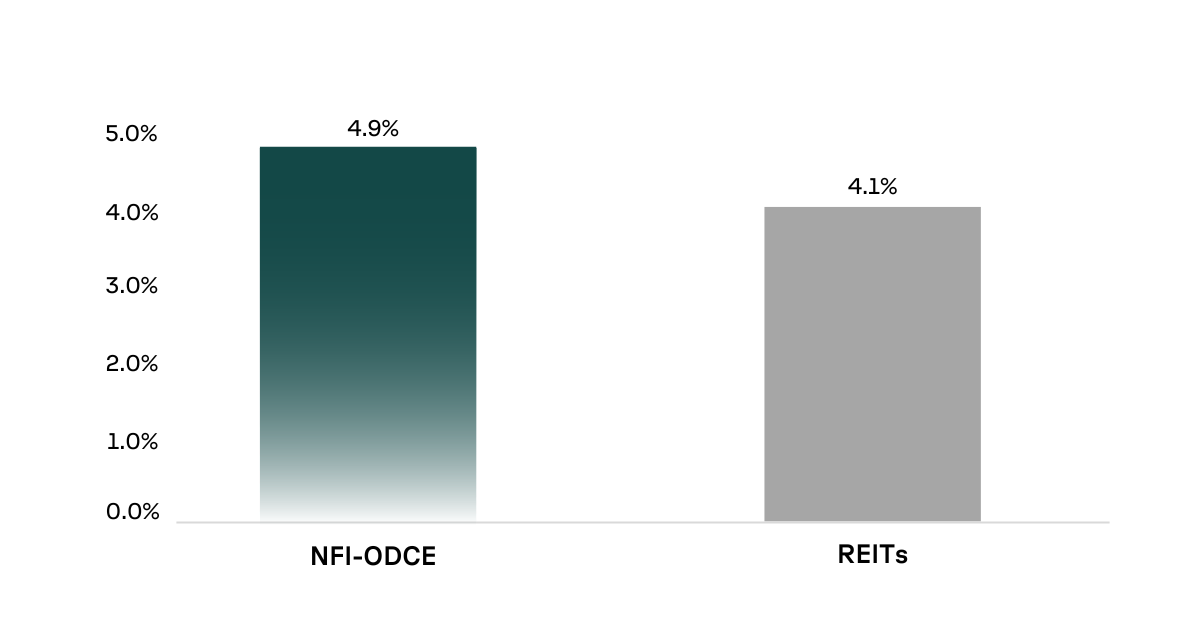

The NFI-ODCE index tracks the performance of the 27 largest and most highly regarded core private equity managers in the U.S. This chart reflects how, collectively, the NFI-ODCE indices’ private real estate funds have performed on an average quarterly return basis during previous inflationary periods.

Average Quarterly Total Return During Periods of Inflation

Source: IDR, NFI-ODCE, FTSE/NAREIT Equity REIT Index (“REITs”). Average quarterly performance during periods of rising inflation. Periods of rising inflation refers to quarters where the YoY change of the consumer price index increases from the previous quarter. Date as of Q4 2022. The NFI-ODCE Index is an index of investments returns (gross of fees) of the largest private real estate funds pursuing a core investment strategy which is typically characterized by low risk, low leverage (less than 40%), and stable properties diversified across the US.

So, if the potential of a sustained inflationary environment is causing your clients concern regarding their investment portfolios, we hope this introduction to private real estate has been helpful.

Sources:

1 https://www.in2013dollars.com/us/inflation/1971?endYear=1980&amount=1

2 https://www.wsj.com/articles/the-coming-demand-surge-brings-back-memories-of-1970s-inflation-11616624489

3 https://www.energy.gov/eere/vehicles/fact-915-march-7-2016-average-historical-annual-gasoline-pump-price-1929-2015

4 https://www.npr.org/2021/05/29/1001023637/think-inflation-is-bad-now-lets-take-a-step-back-to-the-1970s