Now well into 2023, we have a better perspective of how the big four private real estate sectors may perform through the end of this year and into 2024. Broadly, we believe core real estate assets will hold up despite ongoing high inflation, rising interest rates, and the potential for a recession.

Market Backdrop

The torrid pace of escalating rents and capital appreciation many sectors experienced the last two years have now slowed, easing cap rate compression and allowing returns on core assets to return to a more normalized range.

The Fed continues its aggressive position in fighting inflation by using incremental rate hikes which has slowed commercial real estate transaction activity as borrowing costs increase.

Hedging Inflation

As an inflation hedge, we expect core private real estate to help protect investors' purchasing power and also provide the diversification benefits many investors are familiar with.

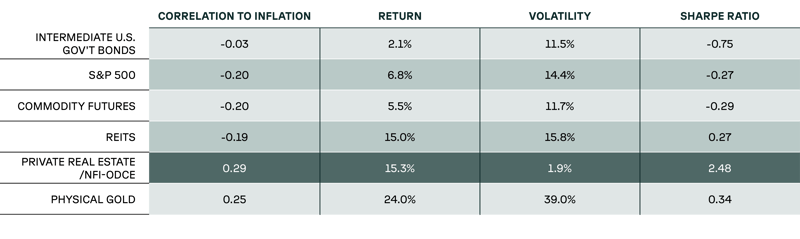

While the Great Inflation chart represented here is not representative of all U.S. inflationary episodes, you can see how private commercial real estate exhibited the highest correlation to headline inflation of all major asset classes when inflation was high and persistent.

Private Real Estate vs. Major Asset Class Classes During the "Great Inflation"

(March 1978 - September 1981)

Sources: Bloomberg LP, Accordant Investments

Indices: Intermediate U.S. Gov't Bonds are Barclay's Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; Commodity Futures are represented by the S&P GSCI Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index.

The Core Four

As our economy continues to recover from a pandemic that is now beginning to show in our rear-view mirror, the four primary commercial real estate sectors may start to return to more typical historical performance patterns.

1. Industrial

Logistics

The industrial logistics sub-sector outperformed other sectors during the pandemic, essentially because lockdowns and work-from-home mandates forced consumers to embrace online shopping. The online sales revolution was well underway before the pandemic but has sinceaccelerated and established a permanent spot as a preferred option for consumer shopping.

As a result, businesses have strong demand to fulfill the "last mile" distribution channel. With that demand, industrial and logistics rents will likely remain strong as demand for these assets continues.

Data Centers

The industrial data center sub-sector remains one of the best performing commercial real estate asset classes, with technology companies fueling the growth of mission-critical infrastructure.

This infrastructure enables consumers of e-commerce, financial services, media and entertainment, healthcare, and other applications to access data seamlessly and without disruption.

The data center sector was resilient during the COVID-19 crisis due to increased internet-connected devices and the evolution of content consumption. We expect demand to increase for digital storage, with data consumption growing exponentially.

2. Multifamily

Before the pandemic, multifamily supply was near its historical average. But as the pandemic subsided, pipelines slowed, and demand increased. Multifamily occupancy rates rose to all-time highs nationally, with properties experiencing robust rent growth across most markets.

Today, as the multifamily sector enters the late stage of the commercial real estate cycle, transaction activity will continue to slow as multifamily housing finds more of a supply-demand equilibrium.

Strategies that focus on acquiring assets below replacement cost, with the potential to add value through renovation and enhanced property management, will continue to be attractive investment opportunities.

3. Office

The outlook for office properties remains mixed for 2023 and beyond as the sector continues to adapt to dynamic market changes brought on by the pandemic. As a result, several key questions need to be answered before an accurate forecast for office can be made.

1. What will overall return-to-work conditions look like for large employers?

2. How will space utilization be reshaped due to COVID-19 spacing concerns?

3. What will be the impact of demand shifting from urban centers to more diverse locations?

As the market gains greater clarity to these questions, we believe attractive investment opportunities will begin to emerge. But, in the meantime, we remain cautious about the office sector.

However, we see one office sub-sector opportunity with government-leased, class A assets. These investments are more likely to withstand a downturn given the asset class's durable credit quality, single-tenant occupancy, and long-term lease structures (often ten or more years).

4. Retail

Retail was the sector most impacted by the COVID-19 crisis. And like office, it may take more time to see how retail assets will respond to new consumer behavior, which the pandemic undoubtedly changed.

As foot traffic and spending increases and landlords look for ways to use space more efficiently, retail again will hold an opportunity for investors.

What's Next?

We trust this snapshot, and forward view of how the four major asset classes could fare this year and next will prove helpful as you continue to monitor and manage your clients' investment portfolios.

If you want to learn more about why private real estate may be an appropriate allocation for your clients, download our free guide, Made for Income: An Advisor's Guide to a Durable Income Alternative.

Important Disclosures

This blog is for informational purposes only and should not be considered a recommendation to purchase any investment product. These materials represents the opinions and recommendations of Accordant Invesment's Research Team and are subject to change without notice. Accordant Investments, its affiliates and personnel may provide market commentary or make investment decisions that are inconsistent with the recommendations or views expressed herein.

Certain information has been obtained from sources and third parties. Accordant Investments does not guarantee the accuracy or completeness of these materials or accept liability for loss from their use As with all investments, there are inherent risks in investing in real estate. Past performance is no guarantee of future results.