Private real estate investors have likely encountered the NFI-ODCE (ODCE) index throughout their investment history, yet for many, the index remains somewhat of a mystery. This discussion aims to clarify any confusion about ODCE (which stands for “Open End Diversified Core Equity” and is pronounced “Odyssey”), its history, property types, and how it can be used in portfolio construction.

What is ODCE?

Private real estate has historically been the investment landscape where institutional investors and family offices allocated a sleeve of their investment portfolios to real assets. And within this private universe, a well-known benchmark index tracking the performance of core investment strategies, has been the standard for measuring investment performance for nearly four decades.

The NFI-ODCE (ODCE) index was created by the National Council of Real Estate Investment Fiduciaries (NCREIF) in 1978 and, as defined on its website, is:

“An index of investment returns reporting on both a historical and current basis the results of 26-28 open-end commingled funds pursuing a core investment strategy, some of which have performance histories dating back to the 1970s. The NFI-ODCE Index is capitalization-weighted and is reported gross of fees. Measurement is time-weighted.”

Core equity represents a lower-risk real estate investment style generally characterized by ownership of stable, premier U.S. commercial properties with low leverage and high occupancy rates.

What is NCREIF?

The National Council of Real Estate Investment Fiduciaries (NCREIF) is an association of professionals with significant involvement and interest in pension fund real estate investments that address vital industry issues and promote research on the asset class.

As defined by the Corporate Finance Institute:

“NCREIF operates as a non-profit entity with the mission to inform concerned parties on the actual performance of the real estate industry, so they can use the information to make informed decisions. The association performs its role by collecting relevant data, analyzing the data, and then presenting it in relevant forms to the target audience.

The NCREIF attempts to inform real estate investors on the risks of return in the market, as well as the current trends that investors should be aware of. It also improves the transparency of the real estate industry through the various statistical data it releases in the market.”

Who are the Managers of the Current Funds in ODCE?

ODCE typically has 26-28 funds included in its quarterly performance report. The funds are managed by many of the premier names in international private real estate investing, including J.P. Morgan Asset Management, PGIM, BlackRock, Morgan Stanley, and MetLife.

Occasionally, new investment managers are added to ODCE, providing their funds satisfy all requirements for inclusion, and at times, some managers are dropped from ODCE, often because their investment objectives no longer meet ODCE inclusion requirements.

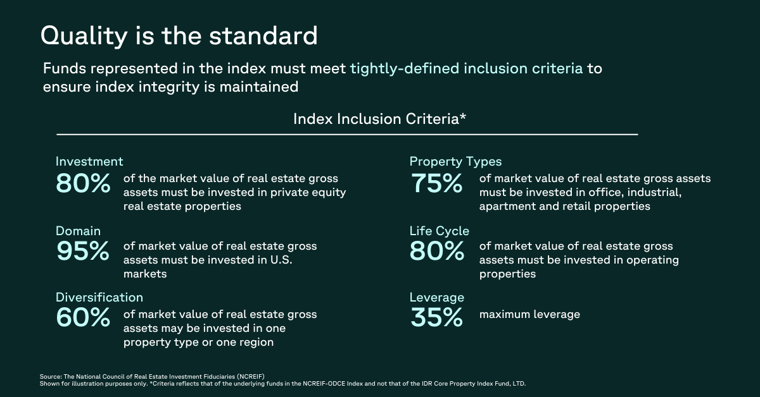

What are the Fund Requirements for Inclusion in ODCE?

To protect the integrity of the index and to maintain accurate and relevant data from a historical perspective, ODCE inclusion requirements must be met before a manager’s fund can be included in the index. And future investment changes within the fund are closely monitored to ensure ongoing compliance with the defined inclusion criteria.

Source: https://www.ncreif.org/data-products/funds/

How is ODCE used in Portfolio Construction?

As mentioned, the ODCE index tracks the performance of funds that pursue a core investment strategy, which is considered a conservative approach to private real estate investing. Many advisors view a core real estate allocation as an income-oriented investment complementary to a client’s fixed income or bond allocation.

What Property Types are Represented in ODCE?

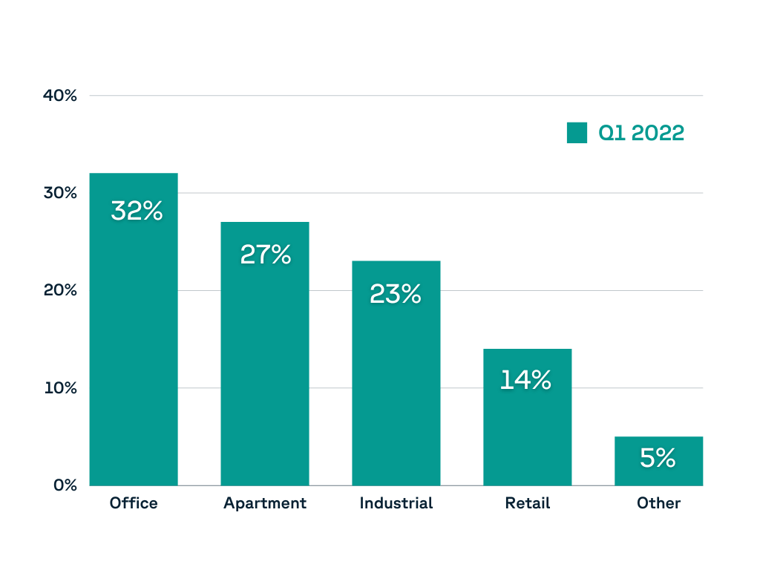

The ODCE Index is broadly diversified across the “big four” traditional commercial real estate sectors–office, industrial, retail, and apartment–although allocations can change according to market conditions, as illustrated by the Q1, 2022 sector breakdown of the index.

Property Type Diversification

Other Questions?

To learn more about ODCE or how you may help your clients access the private real estate asset class, schedule a meeting with a member of our team.

---

Important Disclosures:

The information contained in this Presentation is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, an interest (“Interest”) in a fund or other investment vehicle (collectively as applicable, a "Fund") sponsored by Accordant Investments LLC (“Accordant”), IDR Investment Management, LLC (“IDR IM”), or their affiliates and subsidiaries.

The information contained herein is subject to change, and may not be reproduced, used or disclosed, in whole or in part, without the prior written consent of Accordant and IDR-IM.

Statements contained herein are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Firm. Such statements involve known and unknown risks, uncertainties and other factors, and you should not place undue reliance on them. Additionally, “forward-looking statements” may be referenced. Actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements.

Certain economic and market information has been obtained from published sources prepared by third parties and in certain cases has not been updated through the date of the Presentation. None of Accordant, IDR-IM, nor its affiliates, nor any of their respective employees or agents (collectively, “IDR Entities”) assumes any responsibility for the accuracy or completeness of such information. The IDR Entities have not made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and they expressly disclaim any responsibility or liability for this information. IDR-IM and the IDR Entities do not have any responsibility to update or correct any of the information provided in this Presentation.