As a fiduciary, you diligently evaluate your equity and fixed income investments. You construct portfolios to meet your clients’ specific goals and objectives. You monitor their investments for performance, risk, and evolving market conditions. When needed, you recommend and implement changes to their investment programs and financial plans to help them achieve their desired life outcomes.

Today’s market conditions require you to be as active as ever in delivering on those responsibilities for your clients. Inflation, rising rates, volatility, market drawdowns, and the possibility of a recession likely have caused you to explore asset classes beyond stocks and bonds to build better client portfolios. As a result, most advisors recognize the time has come to rethink how to construct diversified portfolios beyond the time-worn 60/40 model.

The Rise of Core Private Real Estate

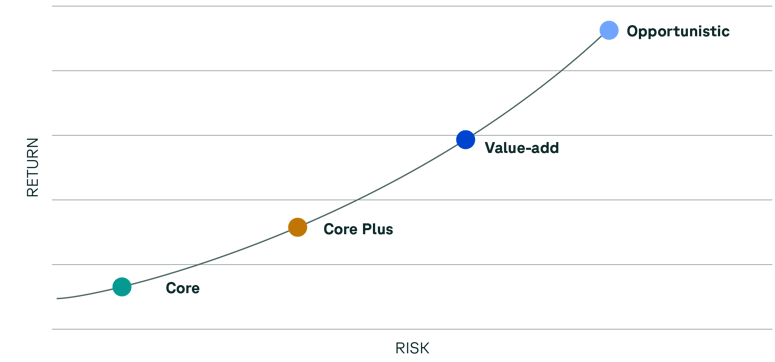

Today, private real estate is an asset class advisors are using to help enhance and diversify client portfolios. And the “core” commercial real estate investment strategy is of increasing interest to advisors looking for another source of durable income. On the risk-return spectrum, core properties represent the lowest risk and return of the four private real estate investment strategies.

Risk Return Characteristics of the Four Pillars CRE Investing

As the most conservative investment strategy, core investments may be more suitable for clients with longer-term investment horizons or for those looking to receive consistent cash flow distributions. Many advisors use core real estate investments to complement a client’s bond allocation, particularly in a rising rate environment when bonds are exposed to duration risk.

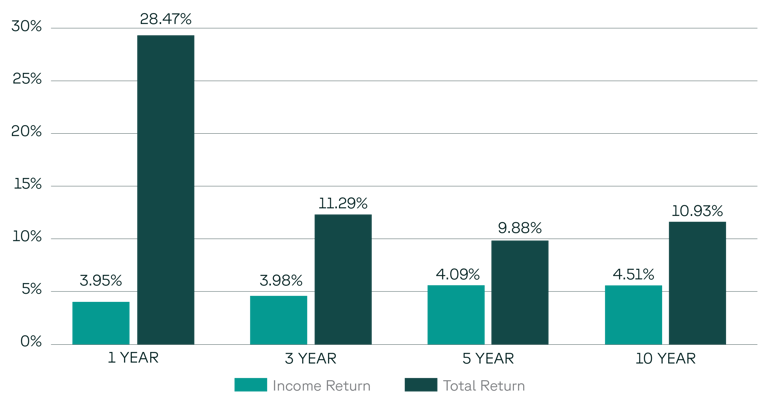

As you can see here, core private real estate, represented by the NFI-ODCE Index, has historically provided relatively stable income.

A Source of Durable Income

Source: IDR, NFI-ODCE. Annualized gross total returns and income from Q1 1978 to Q4 2022. Past performance is not a guarantee of future results.

Core real estate properties are often located in stable, developed markets and have long-term leases with established credit-worthy tenants. Properties are high quality, require minimal maintenance or active management, and are typically capitalized with no more than 30% leverage.

Allocating with Private Real Estate

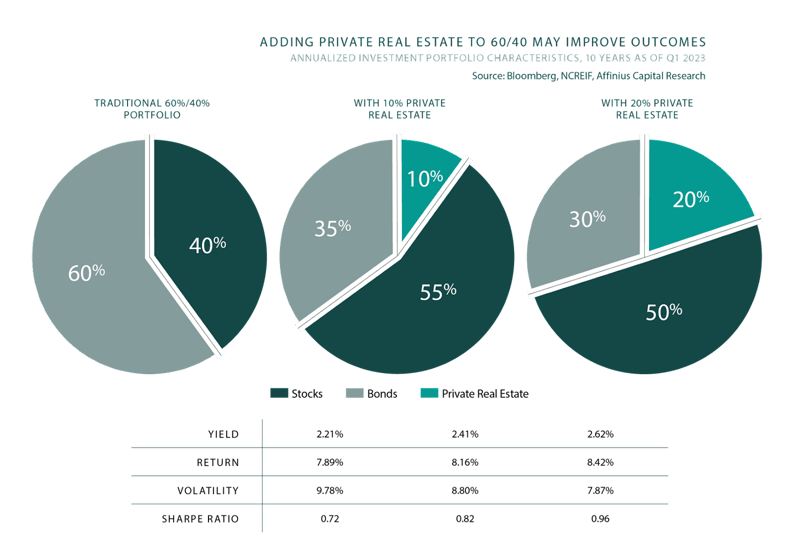

Data suggests that adding core private real estate may be a productive and prudent approach to portfolio enhancement. For example, the graphic below illustrates the impact of adding a 10% or 20% allocation of core private real estate to a traditional 60/40 portfolio.

Adding Private Real Estate to a 60/40 Portfolio May Improve Outcomes

Annualized Portfolio Performance Characteristics; 10 Years as of Q1 2023

Historically, adding core private real estate has increased income, helped reduce volatility, and enhance Sharpe ratios while maintaining long-term returns.

Adding Core Private Real Estate to the 60/40 Portfolio May Reduce Volatility and Enhance the Balance of Risk and Return

Core private real estate can also be useful across the spectrum of potential portfolio allocations and risk-return profiles:

Democratizing Core Private Real Estate

We believe core private real estate is an important allocation to consider for your client portfolios. While the asset class has historically been the domain of institutional investors, core private real estate is now available to investors in a low-cost, user-friendly index strategy that tracks the NCREIF-ODCE index. Allocating to core private real estate has come of age among advisors, and in light of today’s investment environment, not a moment too soon.

Don’t Forget

If you haven’t downloaded our newest guide, Building a Better 60/40 Portfolio with Core Private Real Estate, you can do so now and enjoy a comprehensive perspective on this important asset class.