Bring up the topic of private real estate today, and you’re likely to invite a host of opinions about the industry’s demise. However, it’s crucial not to paint all sectors the same. Despite the prevailing narrative of high vacancy rates and lower property valuations, certain segments of the private real estate market have weathered the storm more resiliently than others.

Market Dynamics

Private real estate has been marked by challenges such as soaring borrowing costs, dwindling occupancy rates, and a significant reduction in sales transactions which hurt price discovery as buyers and sellers have struggled with determining property valuations in a more volatile interest rate environment.

A Look at the Market Cycle

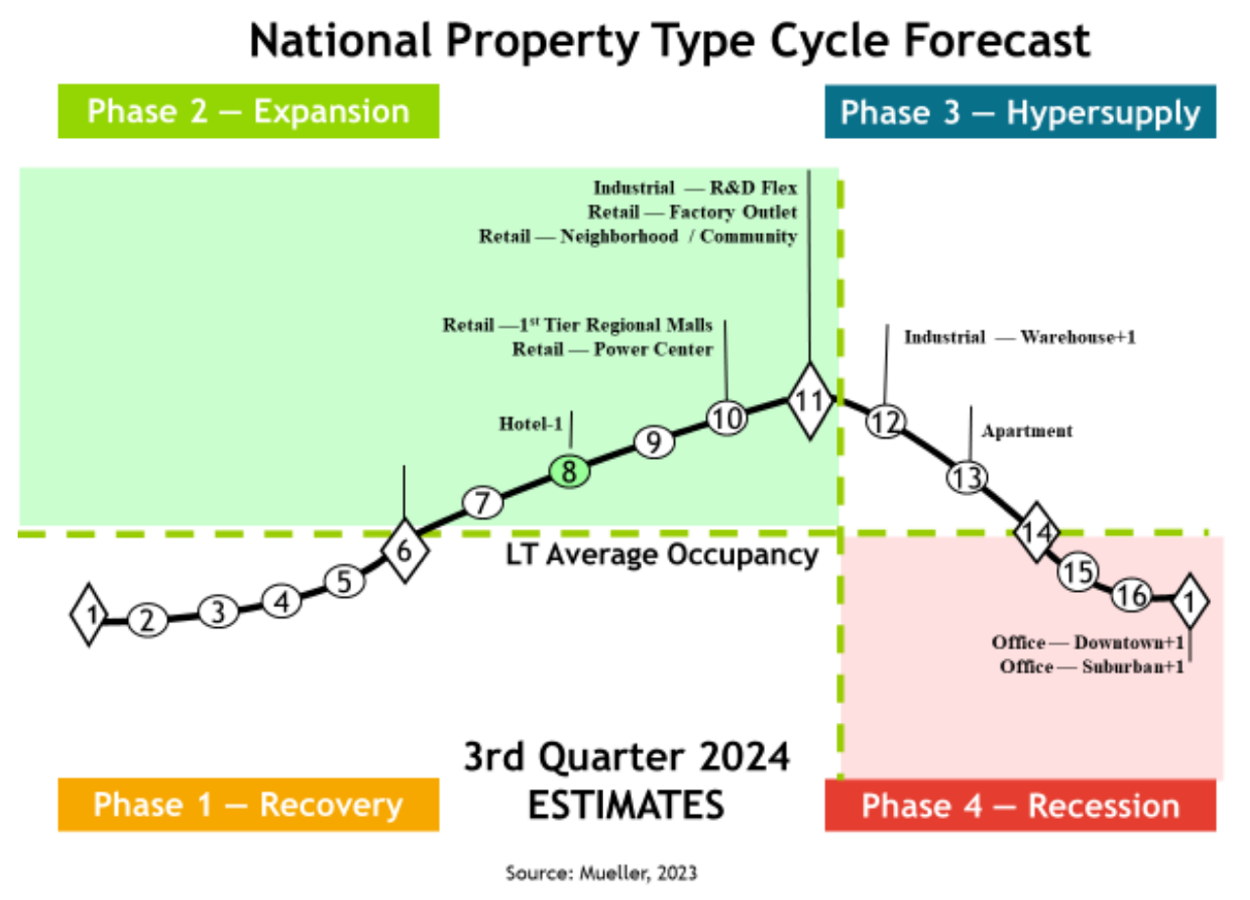

Amidst the prevailing uncertainties, insights from experts like University of Denver Professor Glenn R. Mueller provide valuable perspective. Mueller’s Market Forecast, which has been tracking the private real estate sector’s performance by market cycle phase and geography for decades, offers an alternative view. While the office sector - suburban and downtown – is grappling with the aftermath of the pandemic-induced work-from-home shift, the chart below shows that other property types have exhibited resilience.

MUELLER REAL ESTATE MARKET CYCLE FORECAST

Third Quarter 2024 Estimates

Source: MUELLER REAL ESTATE MARKET CYCLE FORECAST

Glenn R. Mueller, PhD - Professor, Franklin L. Burns School of Real Estate & Construction Management

Mueller’s report reveals sectors that show promise amidst the volatility. Apartments, despite being in a hypersupply phase, are generally expected to hold their values with stabilized rents. Industrial and retail are still enjoying strong performance in both, the expansion and hyper supply phases. Given the extended length of time that each of these phases can last, Mueller’s insights suggest that of the big four private property types, three may perform well throughout 2024.

Promising Sectors

The industrial sector has been private real estate’s darling for the last several years. Fueled by the robust surge in online shopping, there has been steady demand for warehouses and distribution facilities, essential to facilitating speedy deliveries. While there are signs the industrial sector’s growth rate may slow as new supply reaches an equilibrium with current demand, there are still strong demand drivers to sustain sector performance. Among these are the rising demand for cold storage and the resurgence of reshoring activities, aimed at boosting domestic manufacturing and mitigating supply chain issues.

Perception of the retail sector for many private real estate investors centers around expansive suburban malls, which undoubtedly faced their share of challenges during the pandemic lockdowns. However, retail includes other types of properties, including suburban neighborhood shopping centers, often anchored by a major grocery chain. These properties are poised to maintain robust performance, meeting consumers’ needs for convenience.

Nationally, the multifamily apartment sector is widely perceived to be in the hyper supply phase of the private real estate cycle. While a large volume of completions this year are expected to temper the rent growth experienced over the previous few years, persistently high mortgage rates are expected to continue pricing out would-be homebuyers, thereby maintaining healthy demand for multifamily properties.

Conclusion

As an asset class uncorrelated to publicly traded stocks and bonds, many investment advisors find private real estate a helpful diversifier when constructing model portfolios for their clients. But just like the broader economy, private real estate undergoes market cycles, each property type progressing through these phases at its own pace, influenced by the dynamic nature of market conditions.

Today, the industrial, retail, and multifamily sectors appear to be positioned to continue exhibiting stability while other sectors may experience underperformance. To avoid the guessing game of what’s hot and what’s not, we find that many advisors are choosing to hold a broadly diversified portfolio of all property types as a long-term strategic allocation for their clients. The old adage, “you can’t time the market,” holds as true for private real estate as it does for equities and fixed-income securities.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Accordant is not adopting, making a recommendation for or endorsing any investment strategy or particular security or property mentioned in this article. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Accordant Investments, LLC (“Accordant”) cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.

Accordant has not made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and they expressly disclaim any responsibility or liability, therefore Accordant does not have any responsibility to update or correct any of the information provided in this article.

All real estate investments have the potential for value loss during the life of the investment and the sponsor can make no assurances that any investment will achieve its objectives, goals, generate positive returns, or avoid losses.