With inflation continuing to dominate headlines this new year, are your clients worried about how long high inflation will last? How high inflation may affect their investments? They’re not alone.

In January, the Michigan Consumer Sentiment Index dropped to its second-lowest reading in a decade, with consumers ranking inflation as their top concern.1

Chances are, you may have already reduced fixed income exposures. Perhaps you added one of the traditional inflation-hedging strategies like TIPS or commodities to your portfolios to help shield them from inflation’s erosive effects. But private real estate, in particular, is drawing increased interest among RIAs as an alternative approach to hedging inflation.

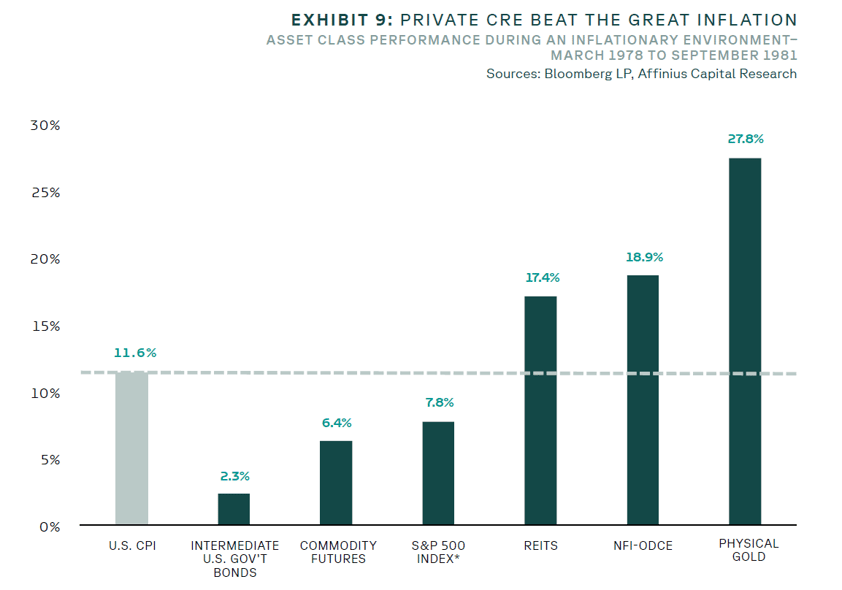

Outperformance in the “Great Inflation”

Historically, private real estate performed well during certain periods of rising or extended inflation. As represented here by the NFI-ODCE index, private real estate proved to be an effective strategy during the height of the Great Inflation, one of the worst inflationary times in U.S. history.

Note: For reference, the NFI-ODCE private real estate index, pronounced “Odyssey” by index followers, was created by the National Council of Real Estate Investment Fiduciaries (NACRIEF) in 1977 and today remains the leading institutional benchmark for core private real estate in the U.S. Many consider it to be the S&P 500 of commercial real estate.

“Great Inflation” Asset Class Performance

March 1978 - September 1981

Indices: Intermediate U.S. Gov’t Bonds are Barclay's Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; Commodity Futures are represented by the S&P GSCI Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index.

What makes private real estate attractive to many advisors is that it has historically helped protect investment portfolios in certain market environments in three unique ways. And while these portfolio protection characteristics may not be effective in every inflationary scenario, it’s worth taking a closer look at each.

Income Protection

Many commercial real estate contracts are written with rent escalation clauses tied to the Consumer Price Index (CPI), which enable owners to raise rents regularly in tandem with increases in the CPI. At a minimum, these rent adjustments help sustain consistent cash flows as prices rise, helping to provide stable distributions to investors.

And property types like multifamily housing that may not include index escalation clauses can often raise rents at a higher pace than the CPI if market conditions allow, especially in high-demand areas, due to the fact rental contracts generally reset every six to 12 months.

Price Appreciation

Real estate historically has held its intrinsic value because it may be scarce in certain markets and sectors. And since inflation is often fueled by high consumer demand amidst limited supply, the result may be price appreciation. And, as building material costs increase, new construction becomes more expensive, boosting replacement costs on existing real estate.

Also, as many investors rotate capital out of bonds and certain stock sectors during high inflationary periods, private real estate can benefit as increased investments can help raise property valuations, further fueling appreciation.

Portfolio Stability

Private real estate exhibited the highest correlation to headline inflation of all major asset classes during the Great Inflation. While past performance is no guarantee of future results, private real estate also had the most favorable risk-adjusted return profile during this period, as illustrated below.

Private Real Estate vs. Major Asset Class Classes

During the “Great Inflation”

(March 1978 - September 1981)

Indices: Intermediate U.S. Gov’t Bonds are Barclay's Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; Commodity Futures are represented by the S&P GSCI Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index.

You can see how a private real estate allocation could help reduce portfolio volatility and improve overall risk-adjusted returns when inflation is high.

Your Clients Look to You

Your clients rightfully look to you for your expertise to position their investment portfolios to perform in various economic and market environments, including rising inflation. The historic diversification benefits and attractive risk-return profile of private real estate potentially make it a compelling strategy that can help you meet those expectations.

----

Sources:

1 https://www.investopedia.com/consumer-sentiment-dips-in-january-2022-5215962