Many of your clients recognize the value of diversifying their stock and bond portfolios with real estate. And whether you help them access this asset class through publicly traded securities or private funds, real estate may help reduce overall portfolio volatility and may prove to be an effective alternative source of income.

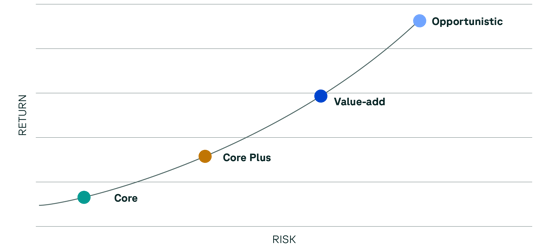

But, your clients might not be familiar with the different commercial real estate investment strategies managers use, and it is worth reviewing what the industry considers the two main pillar strategies, “core” and “non-core,” and the two sub-strategies within each. As the chart below illustrates, each distinct strategy has its own risk/return characteristic and that is why it is important to understand each approach in order to help determine if one is suitable for a given client.

Risk Return Characteristics of the 4 Pillars CRE Investing

Based on our extensive experience as a private real estate investment management firm, we offer our perspectives in this post on the characteristics, typical leverage rates, and the types of returns inventors might anticipate over time with each strategy.

Based on our extensive experience as a private real estate investment management firm, we offer our perspectives in this post on the characteristics, typical leverage rates, and the types of returns inventors might anticipate over time with each strategy.

Core Strategies

Core investment strategies generally focus on acquiring and owning assts with dependable income streams and relatively stable value and often involve lower leverage. Properties in the Core category can include assets undergoing minor renovation or expansion where there is a relatively low impact on the property’s occupancy or operations.

Core

Core real estate is generally considered the most conservative private real estate investment strategy. As a result, it may be most suitable for clients with longer-term investment horizons or those looking to receive consistent cash flow distributions.

Core properties are often located in stable, developed markets and have long-term leases with established credit-worthy tenants. Properties are high quality, requiring minimal maintenance or active management, and are typically capitalized with no more than 30% leverage. Average annual returns are often in the 7-9% range, with most of the return attributable to cash flow.

Many advisors view a core real estate investment as complementary to a client’s income or bond allocation.

Core Plus

Core plus property investments have slightly higher risk characteristics than core but may offer higher return potential.

Properties are usually high quality and generally occupied by quality tenants. However, certain assets may require minor upgrades and improvements, enabling owners to increase cash flows as leases expire and new tenants are secured.

Leverage is often in the 30-50% range, and expected annual returns are generally 10-12%, achieved through a combination of income and appreciation. Thus, core plus property investments may be appropriate for clients seeking income and growth.

Non-Core Strategies

Non-core investment strategies generally focus on value-creation with the intent of producing higher total returns than are typically available in Core investments. Development, redevelopment, renovation, expansion, significant re-leasing, and other transitioning investment activities are characteristic of Non-Core asset strategies. The two sub-strategies in the non-core category are Value Add and Opportunistic.

Value Add

Value add investments are characterized by properties that may be in good locations but are older and in significant need of physical improvements and renovation. Value-add investing aims to purchase aging properties at a reasonable price and “create value” by making upgrades and managing the properties more efficiently.

These investments generally don’t provide significant cash flow until improvements are made, properties are brought up to market standards, and new leases are secured at higher rent rates. Value add investments are often capitalized with 50-60% leverage. Expected average annual returns may typically range from 12%-15%.

Since value-add investments are capital intensive and require time to achieve their projected rates of return, they may be more suitable for clients who have a high risk tolerance, are seeking growth in their investment portfolios, and do not need immediate cash flow.

Opportunistic

The highest strategy reflected on the real estate risk-return spectrum is the opportunistic investment. Opportunistic investment properties have the least predictable cash flows but offer the highest return potential.

Properties may be completely vacant, needing massive repairs or even total repositioning. Opportunistic investments can include underdeveloped raw land or complete ground-up development. Due to the long time horizons required to develop opportunistic properties and the high level of capital required (leverage can be 70% or greater), clients should be aware that it may be years before they receive any return on their investment.

However, average annual estimated returns can be as high as 20% or greater, which may be suitable for certain clients with the highest risk tolerance and longest investment time horizons.

Summary

As you can see, core and non-core investment strategies can help address various client goals and objectives. From conservative to aggressive approaches and with objectives ranging from income to capital appreciation, you can help clients diversify their portfolios while also providing alternative investment solutions that can potentially improve risk-adjusted returns as well.

We hope this information has helped clarify the different types of private real estate strategies that many clients may not be familiar with.

---

Sources & Important Disclosures

Core Benchmark: NFI-ODCE Index

The NFI-ODCE Index is a capitalization-weighted, gross of fees, time-weighted return Index comprised of 27 open-ended diversified core equity real estate funds.

Core-plus: NFI-OE Index

NFI-OE is an aggregate of open-end, commingled equity real estate funds with diverse investment strategies.

Value-add: Cambridge Associates Value Add Real Estate Index

The Cambridge Associates Value Add Real Estate Index is a horizon calculation based on data compiled from 557 value-added real estate funds.

Opportunistic: Cambridge Associates Opportunistic Real Estate Index

The Cambridge Associates Opportunistic Real Estate Index is a horizon calculation based on data compiled from 632 opportunistic real estate funds

Past performance is no guarantee of future results. Real estate investments involve different degrees of risk, and a client’s financial status and risk tolerance level must be considered.