Featured in Real Assets Adviser, November 2025 Issue

Model portfolios have become the default for how wealth is managed at scale. By mid-2024, assets in turnkey asset management platforms (TAMPs) surpassed $4 trillion—$5 trillion when including adviser-led and proprietary models.

Yet for all their growth, most model portfolios still look a lot like they did 20 years ago. Roughly 70% follow the traditional 60/40 allocation of stocks and bonds. The strength of that approach depends on the two asset classes moving in opposite directions to offset one another. But in practice, that has not always been the case. In 2022, both stocks and bonds fell, producing a −16.8% return. Since then, correlations have fluctuated but often stayed positive, shaped by inflation, higher-for-longer rates, and uncertainty.

Alternatives Are Going Mainstream

The search for diversification is bringing alternatives into focus. Private markets—including private real estate, private credit, and private equity—have become too large to ignore. Private real estate alone has grown into a $21 trillion asset class, the third largest behind stocks and bonds. Private wealth allocations are catching up: cumulative flows into alternatives are projected to surpass $1 trillion by the end of 2025.1

Even so, average client portfolios still allocate only 2–3% to private markets—far short of the 10–20% that history suggests could strengthen outcomes. Advisers are signaling change: over 90% plan to increase allocations to alternatives, and more than three-quarters want access delivered seamlessly within model portfolios.2

Bringing Resilience to Model Portfolios

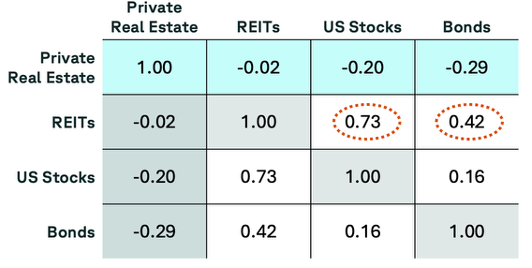

Among private market options, private real estate stands out for its diversification benefits.

CORRELATION, PAST 15 YEARS:3

The importance of this shows up in outcomes. Over the past 15 years, private real estate posted negative performance in only 8 quarters—versus 12 for equities, 17 for bonds, and 19 for REITs. During recessionary periods such as the early 1990s downturn, the Tech Bubble, the Global Financial Crisis, and the COVID-19 shock, it declined just −13.1% on average, compared with −30% for equities and −32.7% for REITs. For model portfolios in search of less volatility, the case for private real estate is clear.

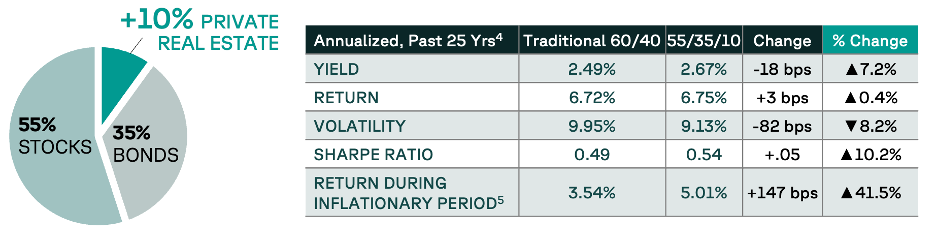

The Portfolio Impact of a 10% Allocation

The effect of including private real estate in a model portfolio can be measured.

For advisers tasked with delivering dependable outcomes across cycles, these numbers speak directly to better risk management and client experience.

The Structural Fit of Interval Funds

Historically, barriers around liquidity, valuations, and investor eligibility kept private markets out of model portfolios. That is changing with interval funds. They are legally required to provide quarterly liquidity—typically 5% of net asset value—enough to cover most rebalancing and partial redemption needs. This contrasts with tender offer funds and non-traded REITs, which also offer periodic liquidity but can reduce it at the manager’s discretion.

They also offer transparency through regular NAV calculations, audited financials, and ’40 Act governance. And because interval funds carry no accreditation requirements with ticker-based investment execution, they can be broadly integrated into model portfolios without creating operational hurdles for advisers or platforms.

Conclusion

Model portfolios define the investment experience for millions of households. As they evolve, the need for diversification beyond the 60/40 has never been clearer.

For advisers and TAMPs building the next generation of model portfolios, private real estate is no longer just an alternative—it is the missing piece.

IMPORTANT DISCLOSURES

All data as of Q2 2025 unless otherwise noted. 1Robert A Stanger; 2CAIS; 315-year correlation of total gross returns for all asset classes. Source: NFI-ODCE Index (“Private Real Estate”), FTSE Nareit Equity (“REITs”), S&P 500 (“U.S. Stocks”), Bloomberg Barclays U.S. Aggregate Bond Index (“Bonds”); 4Annualized investment portfolio characteristics, 25 years. Source: Bloomberg, NCREIF, Affinius Capital. 5Studied inflationary environment. Since 1978, there have been 27 quarters where annualized inflation was 6% or greater. Average annualized returns for these quarters were – Stocks: 1.5%, Fixed Income: 0.8%, Real Estate: 16.9%. Stocks – S&P 500; Bonds – Bloomberg US Aggregate; Private Real Estate – NFI-ODCE Index.

This article presents the authors’ opinions reflecting current market conditions. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product.

Contributor:

Adam Liebman, Executive Director – Investment Strategist, adam.liebman@accordantinvestments.com, 210.740.9401

Corporate Overview:

Accordant Investments is a registered investment advisor based in Scottsdale,

AZ. Accordant creates investment solutions that allow private wealth investors

to access private real estate in a way that was once only available to the world’s

largest investors.

Corporate Contact:

info@accordantinvestments.com, www.accordantinvestments.com

Copyright © 2025 by Institutional Real Estate, Inc. Material may not be reproduced in whole or in part without the express written permission of the publisher.