November 5, 2025

Private Real Estate: The Missing Piece in Model Portfolios

Featured in Real Assets Adviser, November 2025 Issue Model portfolios have become the default for...

In equities, the rise of indexing has been one of the most transformative shifts of the last half-century. Now a cornerstone of portfolio construction, it has shown to be a reliable and consistent way to grow your wealth over the long term while capturing market performance, minimizing fees, and ultimately reducing the risk of underperforming the benchmark.

Private real estate, however, has historically been different. While investors have had the benefit of measuring themselves against the NFI-ODCE Index—the industry benchmark tracking some of the largest institutional core private real estate funds back nearly 50 years—there was no direct way to invest in it and capture the asset class return. And with these funds having significant investment minimums, attempting to replicate the index through direct allocations to the underlying funds is a challenge for all but the largest institutional investors.

With the introduction of an index-based solution in private real estate, that has changed. Advisers now have the ability to offer their clients exposure to the same benchmark trusted for nearly five decades through a single, simple allocation.

Core real estate has always been a foundation of institutional investor real estate portfolios, serving as a powerful diversifier from equities and fixed income while weathering the ups and downs of market cycles better than more aggressive real estate strategies. Its appeal is straightforward: high-quality, income-producing properties in major markets with favorable supply-demand dynamics. With little-to-no leverage and occupancy in the 90% range, they deliver stable income and provide a natural hedge against inflation.

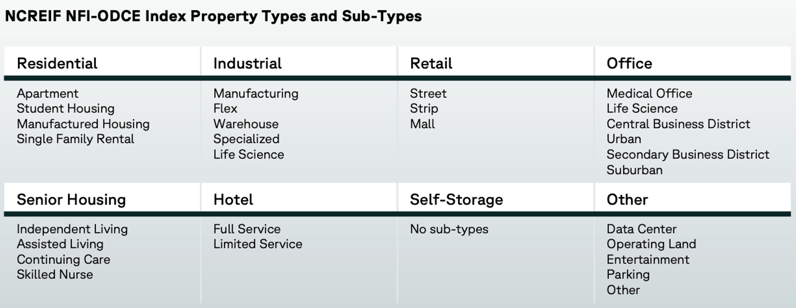

Essentially the large cap index of private real estate, the NFI-ODCE Index is built from the actual portfolios of more than two dozen of the largest open-end institutional core real estate funds in the U.S., representing hundreds of billions in institutional capital. Massive, it reflects a broad, diversified mix of more than 3,750 stabilized properties across major U.S. markets, all managed by household names like JP Morgan, Morgan Stanley, Blackrock, Invesco, and others of a similar caliber. Importantly, the index evolves as the market does. Historically, it was common to hear investors equate commercial real estate with office buildings. While office originally dominated the index, over the last decade, both multifamily and industrial have now grown to become the two largest components. Further, the index has evolved to include newer or niche property types like student housing, self-storage, data centers, medical facilities, and more. Because the NFI-ODCE Index is composed of actively managed funds, it incorporates these shifts in strategy and allocation automatically.

Importantly, the index evolves as the market does. Historically, it was common to hear investors equate commercial real estate with office buildings. While office originally dominated the index, over the last decade, both multifamily and industrial have now grown to become the two largest components. Further, the index has evolved to include newer or niche property types like student housing, self-storage, data centers, medical facilities, and more. Because the NFI-ODCE Index is composed of actively managed funds, it incorporates these shifts in strategy and allocation automatically.

The Passively Managed Aggregation of the Best Ideas Across the Industry

While the NFI-ODCE Index is passive and utilizes a market cap weighted approach to derive performance, each NFI-ODCE Index component fund is run by an institutional investment team that takes an active approach to executing real estate acquisitions, dispositions, financing, and property operations at scale. These managers make decisions on regions, property types, and assets, and have the ability to overweight or underweight from an allocation perspective.

For investors, identifying which managers will outperform—and when—is a challenge, and risks underperformance relative to the benchmark. By using a systematic and disciplined index approach, investors can find success with the goal of simply capturing what the asset class provides historically stable returns through income and protection against inflation.

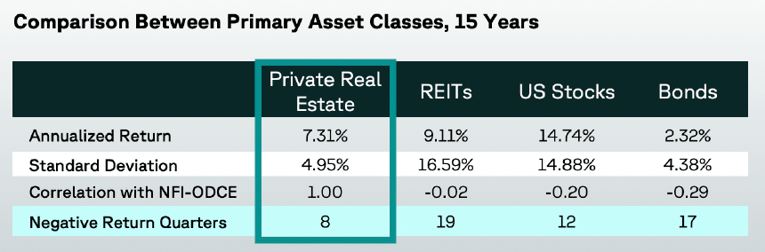

For advisers seeking true diversification beyond the traditional 60/40 portfolio, core private real estate has delivered a compelling risk-return profile, and calling it an alternative investment is a stretch given its conservative strategy vs. more aggressive, complex, and less transparent options like private equity, private credit, or hedge funds. Over the past 15 years, the NFI-ODCE Index delivered an annualized return of 7.3% with a standard deviation of just 5.0%. During the same period, private real estate produced negative performance in only 8 quarters, compared with 19 for REITs, 17 for bonds, and 12 for U.S. stocks.2 Allocating even 10% to private real estate over the past 25 years would have reduced portfolio volatility by 8% and increased returns during inflationary periods by more than 40% compared with a traditional 60/40 mix.3

While the data supporting private real estate’s portfolio impact is well established, manager selection has often been the hardest part of accessing the asset class. Indexation changes that. Instead of relying on a single manager or a handful of funds, allocators can align with the time-tested NFI-ODCE Index benchmark, itself. This means:

No single-manager concentration risk

Exposure that reflects the evolving composition of the industry

Long-term consistency through cycles

A performance profile that has historically offered attractive income with lower volatility than equities

Contrary to traditional private fund structures, which often require accreditation, long lockups, and limited liquidity, semi-liquid structures like the interval fund incorporate a mandated minimum quarterly liquidity option, helping advisers meet the needs of portfolio construction repositioning.

In the case of the industry’s first private real estate index fund—the Accordant ODCE Index Fund—accessibility extends even further: a ticker symbol, daily purchase availability through major custodians, and minimum investment in the low thousands. The ability to provide private real estate across an adviser portfolio has never been easier.

Chasing top-quartile managers may be tempting, but history shows it is difficult to do well, consistently.

For advisers, the index approach to private real estate can help overall portfolio construction that is designed to perform steadily through cycles, evolve with the real estate market, and hold its place as a conservative, long-term anchor in investor portfolios.

IMPORTANT DISCLOSURES

All data as of 6.30.25. You know the benefits of indexing—lower fees, no manager selection risk, and performance that tracks the industry benchmark. Sources: NCREIF NFI-ODCE Index (“Private Real Estate”), FTSE/NAREIT All Equity REITs (“REITs”), S&P 500 (“Stocks”), Bloomberg Barclays U.S. Aggregate Bond Index (“Bonds”). All indices are unmanaged, not directly investable, and do not reflect any fund fees or charges. Past performance is no guarantee of future results. 1The NFI-ODCE Index tracks institutional real estate funds that own private, appraised commercial properties, typically valued quarterly and less affected by daily market swings. The S&P 500 tracks publicly traded stocks priced in real time. Because one reflects private real estate and the other public equities, their risk, liquidity, and valuation methods differ substantially. Comparing the two offers general context, not a like-for-like performance measure. 215-year annualized total returns for all asset classes are shown gross and include income and appreciation on an annual basis. Standard deviation (risk) is a measure of the volatility or dispersion of historical returns around their central tendency or mean return. 3Annualized investment portfolio characteristics, 25 years. Studied inflationary environment: since 1978, 27 quarters had annualized inflation over 6%; average annualized returns for these quarters were – Stocks: 1.5%, Fixed Income: 0.8%, Real Estate: 16.9%. Source: Bloomberg, NCREIF, Affinius Capital.

This article presents the authors’ opinions reflecting current market conditions. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Investing in the Accordant ODCE Index Fund (“ODCEX”) involves risk, including loss of principal. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Accordant ODCE Index Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained online by visiting www.accordantinvestments.com. The prospectus should be read carefully before investing. For differences between the Class I Shares, Class A Shares, and Class Y Shares, please see the prospectus of the Fund. The Accordant ODCE Index Fund is distributed by ALPS Distributors, Inc (ALPS). Accordant Investments LLC is not affiliated with ALPS.

Contributor:

Adam Liebman, Executive Director – Investment Strategist, adam.liebman@accordantinvestments.com, 210.740.9401

Corporate Overview:

Accordant Investments is a registered investment advisor based in Scottsdale,

AZ. Accordant creates investment solutions that allow private wealth investors

to access private real estate in a way that was once only available to the world’s

largest investors.

Corporate Contact:

info@accordantinvestments.com, www.accordantinvestments.com

Copyright © 2025 by Institutional Real Estate, Inc. Material may not be reproduced in whole or in part without the express written permission of the publisher.

November 5, 2025

Featured in Real Assets Adviser, November 2025 Issue Model portfolios have become the default for...

January 5, 2022

Advisors are increasingly discovering the potential benefits of private real estate: tax-favored...

April 6, 2023

Commercial real estate has been a staple allocation among institutional investors for over 50...