Supply chain shortages. Escalating costs for energy, gasoline, and food. Rising interest rates. Political turmoil. Pressure on the Fed. No end in sight. If this sounds familiar, it should. We are living our version of this scenario today.

You may find it interesting that these same conditions were present during the Great Inflation of the ‘70s and early ‘80s, one of our country’s longest and most challenging inflationary periods. What lessons can we learn from that painful period in history to help us understand our current inflationary environment and what may lie ahead?

Thief in the Night

The peril of inflation may have been summed up best by the noted Fed Chairman of the 1950’s, William McChesney Martin:

“Inflation is a thief in the night and if we don’t act promptly and decisively we will always be behind.”

- Minutes of the Federal Open Market Committee

August 2, 1955

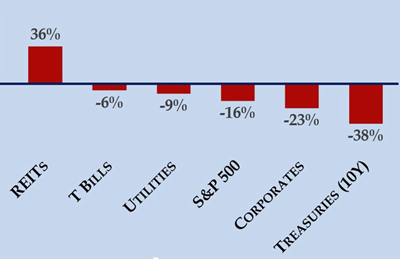

When inflation is low, nominal returns are a practical yardstick. When inflation is high, it’s best to look at returns after inflation. The real, inflation-adjusted returns of major asset classes during the Great Inflation illustrate the corrosive effects of high, sustained inflation.

As illustrated below, other than owning real estate (as represented by the National Association of Real Estate Investment Trusts or NAREIT index), traditional assets lost purchasing power and there were few places to hide.

Total Cumulative Real Returns After Inflation

(1971 to -1981)

Source: marketwatch.com; July 24, 2021 2

History provides a sobering reminder of inflation’s threat to investors. Should we be concerned today?

Understanding Inflation: Causes and Solutions

To better understand inflation, what does history tell us about its origins, nature, potential policy solutions, and likely paths forward?

High Inflation

First, high inflation can have various triggers but is only sustained by the accommodation of policymakers. In the past, sustained 5%+ inflation was often related to war. Inflation is possible without war; it just requires price stability to be subordinated to some other policy priority.

-

Today, that subordinated policy looks very much like the trillions of dollars of government stimulus deployed to reverse the economic impact of a pandemic. When the pandemic burst on the scene, it felt like a war – against a virus.

Sustained High Inflation

Second, sustained high inflation is ultimately a country-specific rather than global phenomenon. While inflation rates may be correlated, they often differ significantly between countries. Inflation can follow different paths in different parts of the world.

-

For example, US inflation was 7% in December 2021, whereas China, Switzerland, Saudi Arabia, and Japan were below 2%.1

Low or Moderate Inflation

Third, low or moderate inflation, considered to be an economic benefit, can be sustained for significant periods without a loss of control. The Golden Age of the 1950s and 1960s demonstrated that inflation could stay at moderate rates above 2% without causing inflation expectations to “unanchor.”

No Soft Landings

And fourth, history shows no soft landings from periods of sustained high inflation. If inflation were to get out of control, there is little precedent to suggest that there would be an easy way out. Sustained high inflation is a psychological and institutional phenomenon, the remedy for which seems to be drastic policy tightening.

The above reflections provide reminders and insights on inflation’s causes and what may follow. Policymakers may be able to mitigate inflation’s impact on consumers and the economy even if we don’t return to the low levels we have enjoyed for years.

On the other hand, if high inflation persists, perhaps the most important lesson from history is recognizing how damaging it can be to the purchasing power of investor capital over time. The “thief in the night” is not kind.

Considering Inflation Hedging Assets

Even with this historical perspective, nobody can predict what inflation will look like tomorrow, how long it will last, or its impact on investors. And that uncertainty is reason enough to consider adding an inflation-hedging asset class to your clients’ investment portfolios.

-----

1https://tradingeconomics.com/country-list/inflation-rate

2https://www.marketwatch.com/story/worried-about-inflation-heres-how-investments-did-in-the-1970s-11626658251 Total returns in 'real' purchasing power terms. SOURCES: NYU STERN, NATIONAL ASSOCIATION OF REITS, KENNETH FRENCH (TUCK SCHOOL OF BUSINESS, DARTMOUTH COLLEGE).