In the world of investments, the cyclical nature of markets often evokes a sense of déjà vu, particularly within the realm of private real estate (PRE). As an investment adviser, it's natural to scrutinize the resilience and long-term growth potential of equity and fixed-income assets to inform your portfolio allocation decisions, and private real estate is no different.

Recently, private real estate has drawn increasing attention (and concern) among advisers, as factors such as high borrowing costs, escalating insurance premiums, and sector-specific oversupply paint a daunting outlook for the industry. But it's crucial to remember that we’ve been here before, and private real estate valuations have a propensity to rebound, delivering the income and returns investors have come to expect.

A Look in the Rear-View Mirror

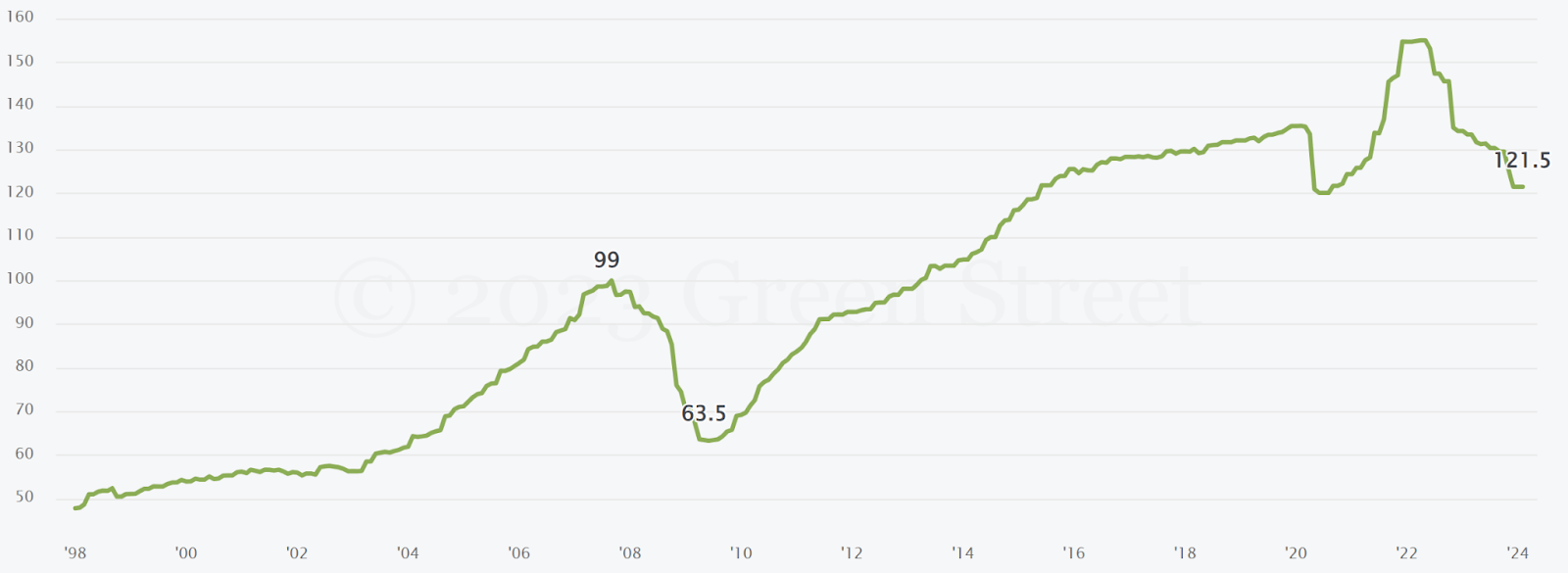

Examining the trajectory of PRE valuations over time serves as a testament to the sector's enduring strength and growth potential. The Green Street Commercial Property Price Index (CPPI) provides valuable insights into the industry’s resilience. When paralleled with the performance of the S&P 500 over similar periods, the narrative of resilience and recovery in private real estate supports the case of why investment advisers increasingly consider it a crucial component of a well-diversified investment portfolio.

All Property CPPI® weights: retail (20%), office (17.5%), apartment (15%), health care (15%), industrial (10%), lodging (7.5%), net lease (5%), self-storage (5%), manufactured home park (2.5%), and student housing (2.5%). Retail is mall (50%) and strip retail (50%).

Core Sector CPPI® weights: apartment (25%), industrial (25%), office (25%), and retail (25%).

Source: https://www.greenstreet.com/insights/CPPI

Historically, the real estate industry has weathered its share of storms, including the dot-com bubble burst (where valuations held steady), the 2008 financial crisis, and the global pandemic shutdowns of 2020 (which ushered in some dire predictions for the industry). Yet, in each case, valuations recovered, followed by extended periods of growth. The 2023 downturn in the index is a reflection of revaluations in the late stages of the cycle, especially in the office sector.

Assessing the Current Environment

As mentioned, high interest rates and soaring insurance costs have stressed the economics of many investment properties. Owners are grappling with spiking operational costs, stagnant rent growth, and diminished transaction activity as the valuation gap between buyers and sellers continues to widen, especially evident with office properties. Despite these challenges, the industrial, suburban retail, and multifamily sectors appear poised to continue delivering the income and returns that have drawn investors to the industry.

The resilience of these sectors stems from the intrinsic value and fundamental demand underpinning many private real estate property types. While current hurdles may seem daunting, they catalyze market self-correction, fostering more sustainable growth in the long term.

Maintaining A Long-Term Perspective

Real estate, by nature, is a long-term investment. While short-term fluctuations may appear volatile, a long-term perspective reveals a pattern of steady growth, resilience, and recovery. As an investment adviser, it’s more beneficial to view private real estate as a strategic allocation rather than a tactical investment.

Moreover, the diversification benefits cannot be overstated. Private real estate generally moves differently than stocks and bonds, providing a cushion against market volatility. This diversification potential enhances the appeal of private real estate as an integral component of a well-rounded investment portfolio.

Conclusion

Despite near-term challenges, the resilience of the private real estate industry should not be underestimated. Drawing on historical trends and the intrinsic value of real estate as an asset class, we believe there is ample reason to anticipate not only a rebound in valuations but also continued long-term growth. Recognizing and leveraging this resilience can translate into stronger returns and income growth for your clients. Again, we’ve been here before.

This information is educational in nature and does not constitute a financial promotion, investment advice or an inducement or incitement to participate in any product, offering or investment. Accordant is not adopting, making a recommendation for or endorsing any investment strategy or particular security or property mentioned in this article. All opinions are subject to change without notice, and you should always obtain current information and perform due diligence before participating in any investment. All investing is subject to risk, including the possible loss of principal. Accordant Investments, LLC (“Accordant”) cannot guarantee that the information herein is accurate, complete or timely. Past Performance does not guarantee future results.

Accordant has not made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties), and they expressly disclaim any responsibility or liability, therefore Accordant does not have any responsibility to update or correct any of the information provided in this article.

All real estate investments have the potential for value loss during the life of the investment and the sponsor can make no assurances that any investment will achieve its objectives, goals, generate positive returns, or avoid losses.