Like many wealth advisors, you may have made allocation changes and additions to your clients’ portfolios with the intention of improving their risk-adjusted returns amidst a stubbornly high inflationary period.

Inflation might not directly impact the public markets. Still, persistently high inflation may create a heightened sensitivity among investors about what actions the Federal Reserve might take with additional rate hikes. And uncertainty about the economic impacts of future Fed rate increases can elevate market volatility for extended periods.

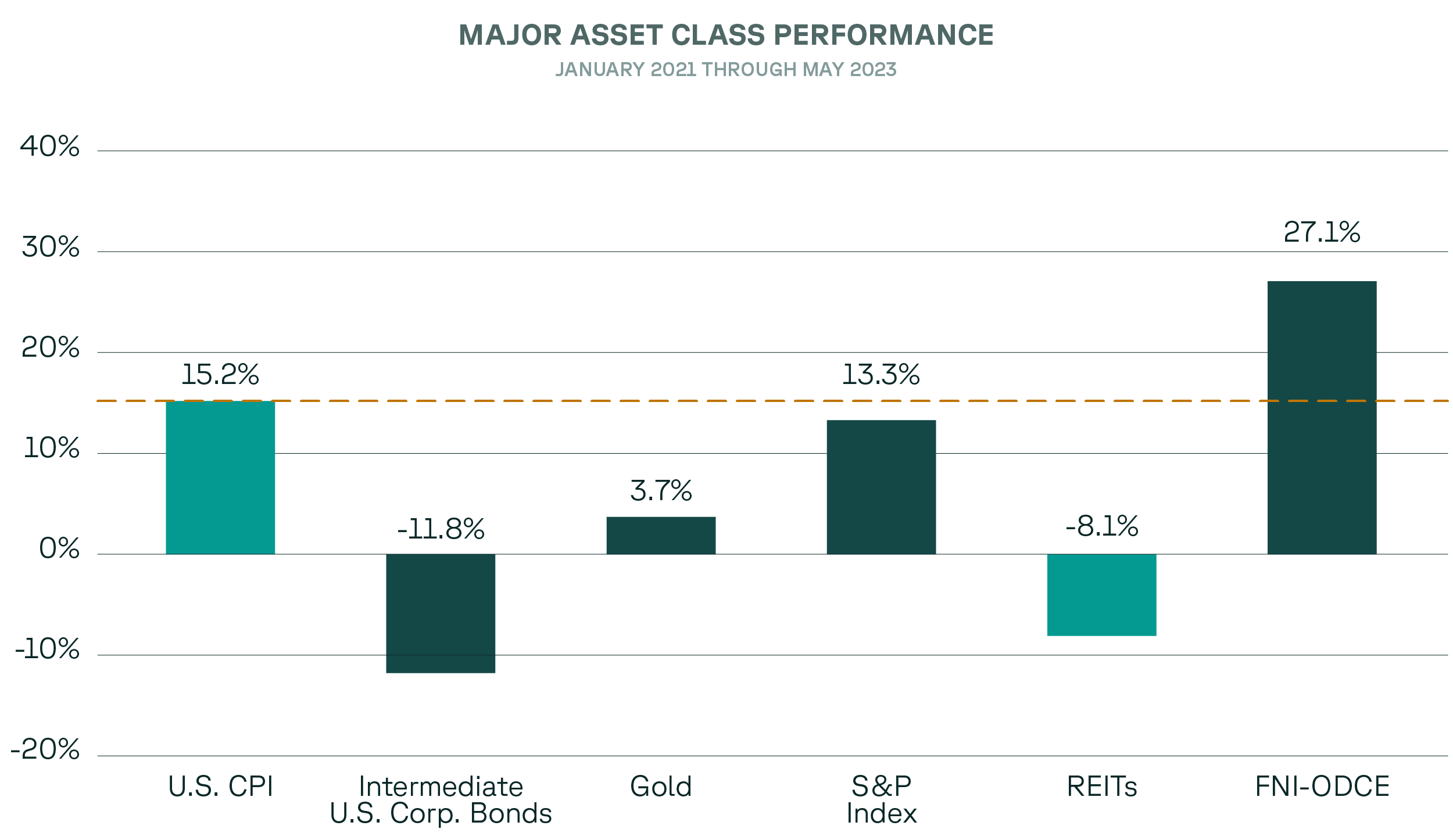

Ever since our current episode of rising inflation began, asset managers and economists have offered historical perspectives on how stocks, bonds, and other alternative asset classes performed during previous inflationary episodes.

Yet, when reviewing your clients’ portfolio allocations, it may be more valuable for you to evaluate how asset classes are performing today since we now have nearly 20 months under our belt from when inflation began its steady ascent in January 2021.

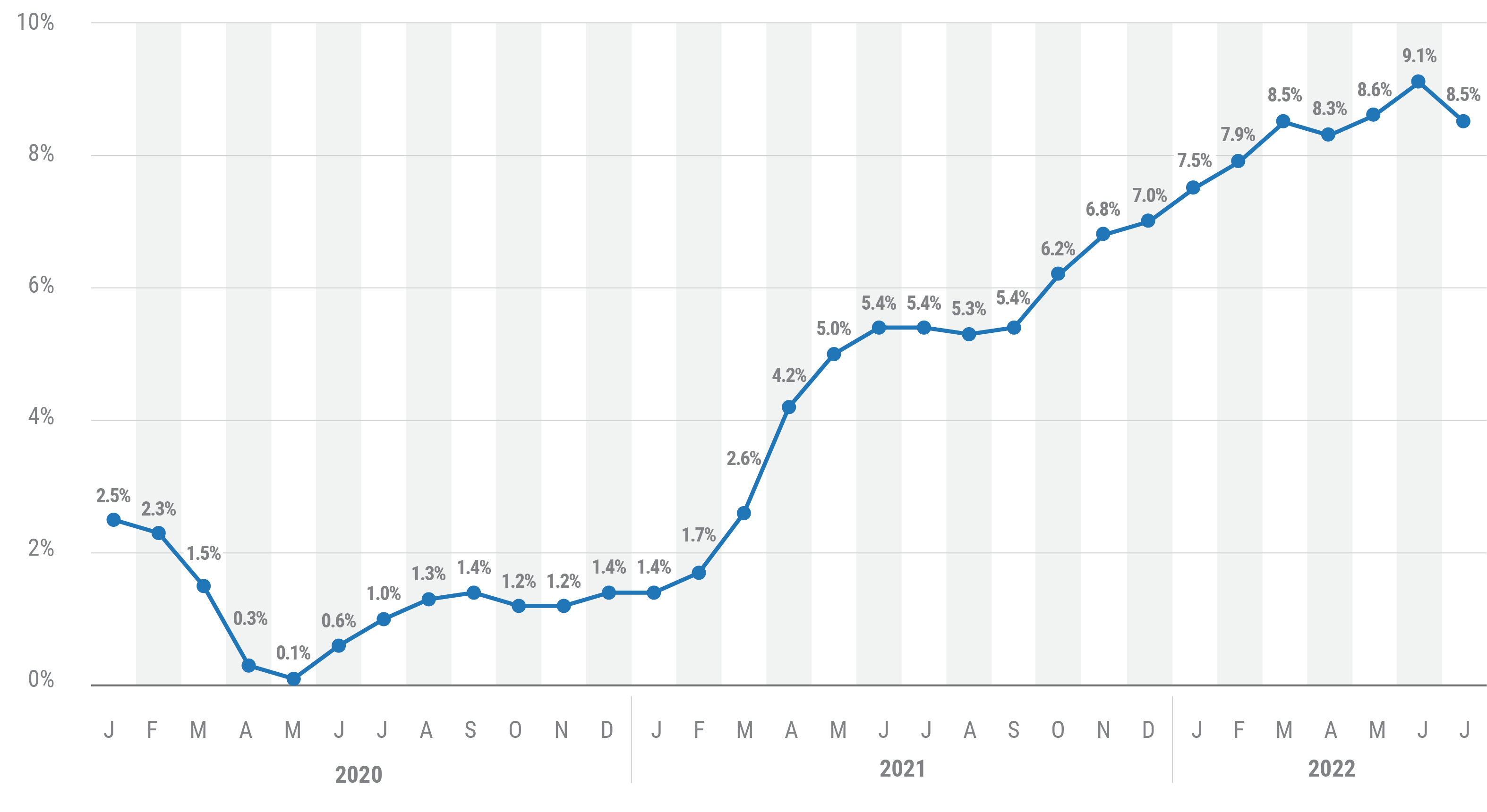

Monthly 12-month inflation rate in the United States

January 2021 to September 2022

|

|

Source: statista.com

|

As mentioned, inflation may not have a direct influence on the performance of stocks, bonds, and other alternative investments, but it can certainly wreak havoc on the economy, which ultimately can affect the valuations of securities, potentially causing many to not keep pace with the CPI as this chart reflects.

Major Asset Class Performance During Current Inflationary Period

Traditional thinking holds that inflation can be an ally of real estate because property values may increase as higher construction prices causes property replacement costs to rise. And landlords have the ability to re-price their rents as their operating costs increase. These characteristics may help explain why public REITs and private real estate (as represented by the NFI-ODCE index) are performing well in our current inflationary episode compared to other asset classes.

The NFI-ODCE (pronounced Odyssey) index is an industry benchmark that institutional investors have used since 1978 to track the performance of a select group of premier investment management firms that own and manage diversified portfolios of institutional-quality core real estate throughout the United States.

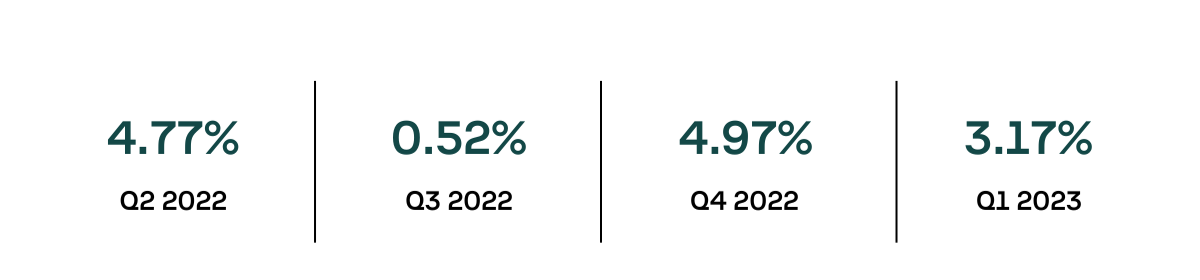

A closer look at private real estate quarterly performance shows relatively stable returns throughout the past two years when inflation was low AND high, suggesting the asset class may be a valuable all-weather portfolio allocation long after today’s high inflation subsides.

NFI ODCE Quarterly Returns Q2 2022 - Q1 2023

This table represents total gross (value-weighted) for the NFI-ODCE index.

Conclusion

It’s important to note that private real estate is not immune to changing economic and market conditions due to inflationary pressures. Rising interest rates and the threat of a recession may affect property valuations and cash flows.

To learn more about private real estate and how you can access the asset class for your clients with a diversified index investment structure, contact us at 833.768.0622 or by email at info@accordantinvestments.com