Durable income, potential appreciation, inflation protection and low correlation to traditional assets. Private commercial real estate (CRE) provides an array of potential benefits to advisors seeking to build more resilient portfolios for their clients in today’s challenging markets. What does the data tell us?

Intrinsically, commercial real estate (CRE) can offer investors attractive debt and equity-like qualities. And as an asset class uncorrelated to stocks and bonds, it may provide a host of other benefits to advisors making allocation adjustments for their clients.

When looking at the historical performance of CRE as we will in this post, the data defines those potential benefits in clear and distinct ways. To illustrate the characteristics of CRE, we use two indices as proxies for the asset class: the NCREIF Property Index and the NFI-ODCE index.

The NCREIF Property Index (NPI) is a quarterly, unleveraged composite total return for private commercial real estate properties held for investment purposes only. The objective of the NPI is to provide a historical measurement of property-level returns to increase the understanding of, and lend credibility to, real estate as an institutional investment asset class.

The NFI-ODCE Index (short for NCREIF Fund Index - Open End Diversified Core Equity), is the first of the NCREIF Fund Database products and is an index of investment returns reporting on both a historical and current basis the results of 38 open-end commingled funds “pursuing a core investment strategy.” The NFI-ODCE index serves a similar role tracking the performance of the private real estate industry as the S&P 500 index serves for U.S. equity markets.

Core real estate is generally considered the most conservative CRE strategy and is typically used by advisors seeking a durable income alternative to traditional fixed-income securities.

Let the Data Speak

As you will see, private CRE historically has exhibited a set of characteristics that may help you address several of today's investment challenges as you make allocation decisions with your clients' portfolios. Next to stocks and bonds, many advisors are beginning to view private CRE as the essential third leg of the investment stool. The potential benefits of private CRE are many and include:

Enhanced, Durable Income

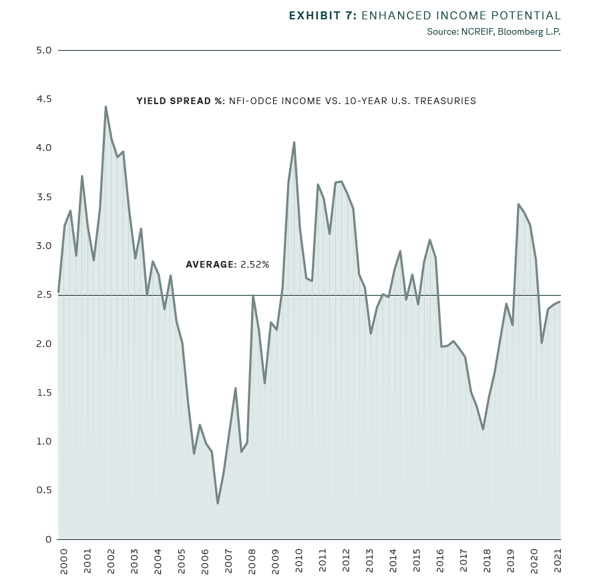

A significant part of private CRE total returns is attributable to the income generated from regular tenant rent payments. Relative to other major asset classes like large-cap equities and corporate bonds, CRE may provide enhanced income due to the relative stability of cash flows investment properties offer. And compared to U.S. Treasuries since 2000, core private CRE has historically generated a stronger relative income profile, averaging a 252 annual spread compared to the 10-year U.S. Treasury.

Yield Spread %; NFI-ODCE Income vs. 10-Year Treasuries

Strong Historical Risk-Adjusted Returns

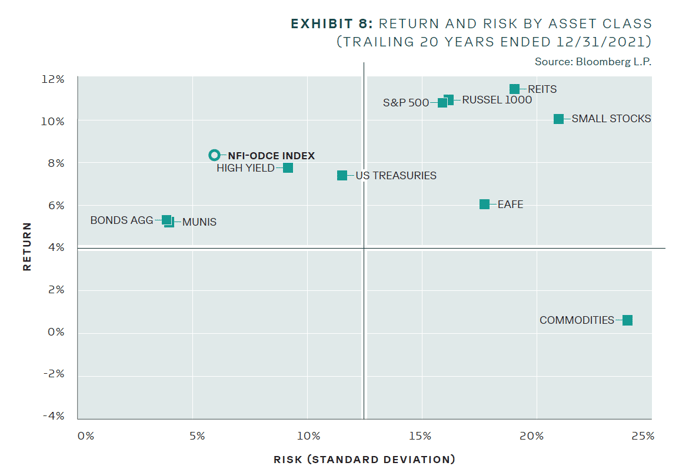

As illustrated here, private CRE has historically generated a strong risk-adjusted return profile for investors. Long-term, in-place lease agreements with creditworthy tenants have generated compelling long-term total returns with relatively low volatility. In addition, high-quality properties generally feature stable valuations and high levels of liquidity. While past performance is no guarantee of future returns, the combination of current income from rent payments plus appreciation in the residual value of the assets has been the primary driver behind the asset class's track record of performance.

Risk and Return by Asset Class (Trailing 20 years)

Note: the NCREIF Property Index uses an appraisal-based calculation methodology, which some market participants believe can lead to an "artificially" low volatility calculation, as measured by standard deviation.

Note: the NCREIF Property Index uses an appraisal-based calculation methodology, which some market participants believe can lead to an "artificially" low volatility calculation, as measured by standard deviation.

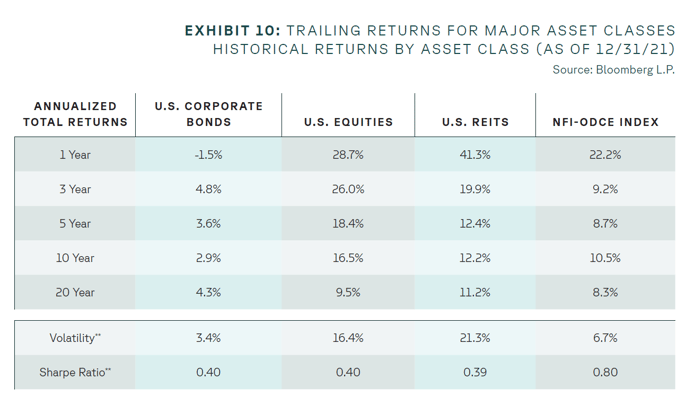

Relatively Low Volatility

Historically, private CRE has provided low absolute and relative volatility as an asset class. As shown here, the NCREIF Property Index has generated annual volatility of 4.4% over the last 20 years. While the volatility for private real estate is slightly higher than for fixed income, it is a fraction of the risk borne by U.S. equity and U.S. REIT investors. Over the trailing 20-year period, private real estate generated the strongest risk-adjusted returns as measured by a Sharpe Ratio of 1.38.

Trailing Returns for Major Asset Classes

**Based on a 20-Year time period

**Based on a 20-Year time period

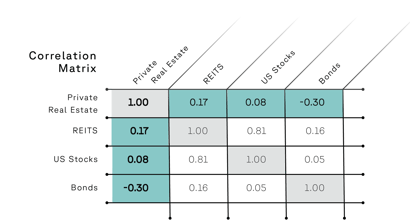

Diversification

Since the inception of the NCREIF Property Index in 1978, private CRE has been uncorrelated with most major asset classes such as stocks, bonds, and public REITs. Including low (or lower) correlated assets can decrease overall portfolio volatility and potentially help improve risk-adjusted returns. As a result, private CRE exposure can add attractive and differentiated sources of return while reducing overall portfolio risk.

Correlation Matrix

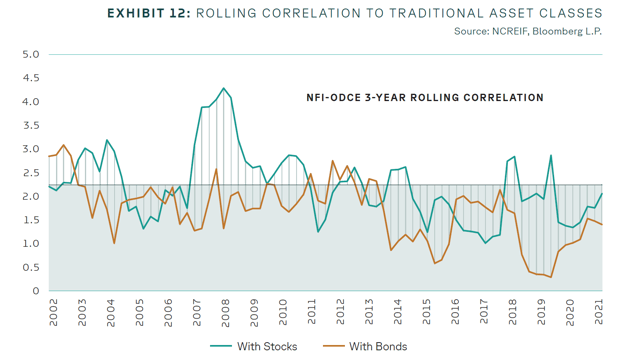

Rolling Correlation to Traditional Asset Classes

Inflation Hedge

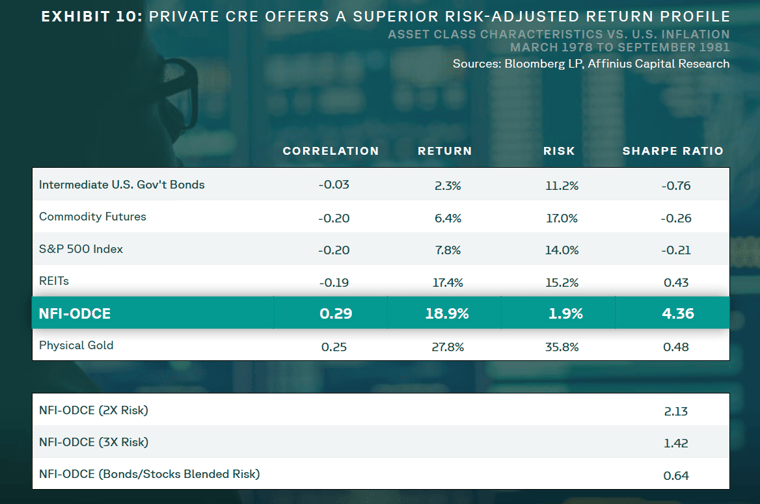

As an inflation hedge, core private CRE has helped protect investors during periods of rapidly rising prices. And while the Great Inflation period highlighted here is not representative of all U.S. inflationary episodes, you can see how private real estate exhibited the highest correlation to headline inflation of all major asset classes when inflation was high and persistent.

Asset Class Performance During Great Inflation

(March 1978 to September 1981)

Indices: Intermediate U.S. Gov't Bonds are Barclay's Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; Commodity Futures are represented by the S&P GSCI Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index

Indices: Intermediate U.S. Gov't Bonds are Barclay's Intermediate Corporate Bond Total Return Index; S&P 500 is represented by the S&P 500 Index; Commodity Futures are represented by the S&P GSCI Index; REITs refer to public REITs and are represented by the FTSE NAREIT All Equity Index; Private real estate is represented by the NCREIF ODCE Index; Gold is represented by the Gold U.S. Dollar Spot Price Index

When presenting the benefits of an investment to an RIA, we recognize it is generally best to let the data tell the story. Through the series of historical illustrations you've just seen here, that is what we have attempted to do for private CRE. RIAs who have used private CRE as an allocation for their clients have generally found the asset class to be a valuable component of a well-diversified portfolio.

Learn More

You may find our guide, Why Private Real Estate?, helpful, as you continue your diligence and discovery of this important asset class.