Some retirement planners have begun to question the efficacy of the narrow 60/40 equity/bond portfolio for pre-retirees building their nest eggs. Moreover, some planners now question how effective a 60/40 portfolio will be for investors in preserving retirement assets. Poor portfolio performance or a market downturn early in retirement can be devastating to retirees, as we will discuss later.

Revising the 4% Rule

In 1994, William Bengen published his groundbreaking research on how a diversified portfolio can sustain a 4% “Safe Withdrawal Rate” to provide a lifetime of income for a retiree. The “4% Rule” became a standard for retirement planners, although more sophisticated modeling has been applied over the years.

Keep in mind that the average rate for the 10-Year US Treasury was 7.09% when Bengen’s paper was published in 1994, and 2007 was the last year the average 10-Year US Treasury rate was over 4%.1 Morningstar published updated research in 2021, revising the safe withdrawal rate down to 3.3% due to low interest rates and high equity valuations.2,3

While it is a noble objective to provide guidance to retirees on how much they can safely withdraw from their retirement accounts, an anemic withdrawal rate of approximately 3% will not be adequate for many. So, how do you help ensure your retired clients can meet their income needs today when yield is scarce and reliance on equity appreciation may be folly? Many advisors are turning toward alternative sources of income.

The Private Real Estate Option

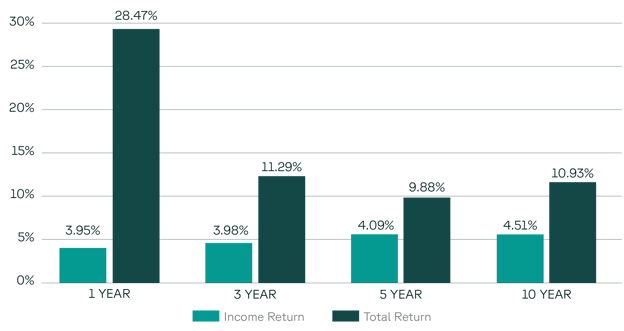

Private real estate, and specifically “core” investment strategies popular with many institutional investors, have drawn heightened interest among advisors searching for historically sustainable sources of adequate income. As illustrated by the NCREIF-ODCE Index, core private real estate has provided income returns of nearly 4% and greater over recent 1, 3, 5 and 10-year time frames.

A Source of Historic Durable Income

Source: IDR, NCREIF-ODCE. Annualized gross total returns and income through Q4 2022. performance is not a guarantee of future results. Index returns are before management and other fees and expenses. An investor cannot invest directly in an index.

The durable historical income of core private real estate can help your retired clients meet their annual spending needs and withdrawal requirements. Moreover, the income from core private real estate may rise along with inflation.

Sequence Risk

Retirees are at greater risk than other investors during market declines. Selling assets to fund withdrawals locks in losses, and retirees may not have enough time for their portfolio to recover. As a result, drawdown risk is a genuine concern, particularly if drawdowns occur early in retirement.

This risk is known as “Sequence of Returns Risk” or “Sequence Risk.” Sequence Risk arises from the order in which returns occur when portfolio withdrawals are underway.

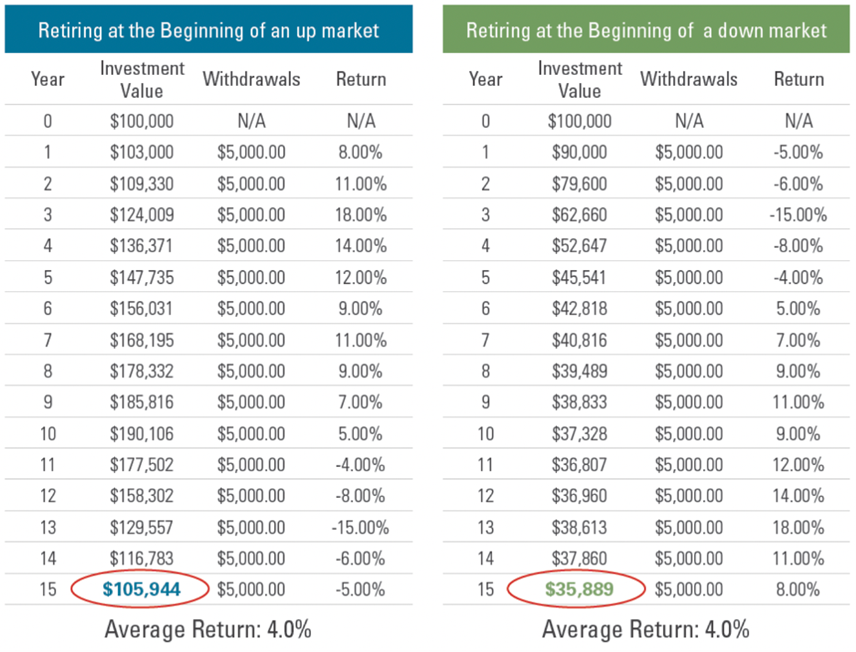

To illustrate, imagine two investors. Each retires with 100,000 and withdraws $5,000 per year from the portfolio. They earn the same annual returns, except the sequence of returns is reversed: one retires at the beginning of a bull market and the other just before a bear market. Despite average annual returns of 4% for each investor, one enjoys a growing capital base, and the other nearly depletes their savings.

A Tale of Two Retirees

Source: https://retireone.com/sequence-of-returns-risk/

Strengthening the Retirement Portfolio with Core Private Real Estate

Core private real estate may offer multiple bulwarks against sequence of returns risk:

- Historically higher yields may provide spendable income, which reduces the need to sell other portfolio assets at an inopportune time.

- The low correlation and low volatility of core private real estate help buttress a portfolio from sudden drawdowns in the equity market.

Keep in mind that real estate may be subject to economic downturns, yet the timing of the impact has been historically different than on publicly traded securities.

Importantly, core private real estate, with its history of durable income, potential appreciation, and diversifying characteristics, can help improve retirement outcomes for multi-asset portfolios and may help mitigate the sequence risk that can disrupt retiree plans.

---

Sources:

1https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

2https://www.cnbc.com/2021/11/11/the-4percent-rule-a-popular-retirement-income-strategy-may-be-outdated.html

3https://www.morningstar.com/lp/the-state-of-retirement-income